Why Use an Online Paystub Generator?

Automation is one of the most powerful tools a business owner can leverage to streamline operations and save valuable time. Payroll processing is often one of the most complex and time-consuming tasks, but using an online paystub generator can simplify the process significantly. Instead of manually calculating wages and deductions, employers can rely on automation to reduce errors and ensure compliance.

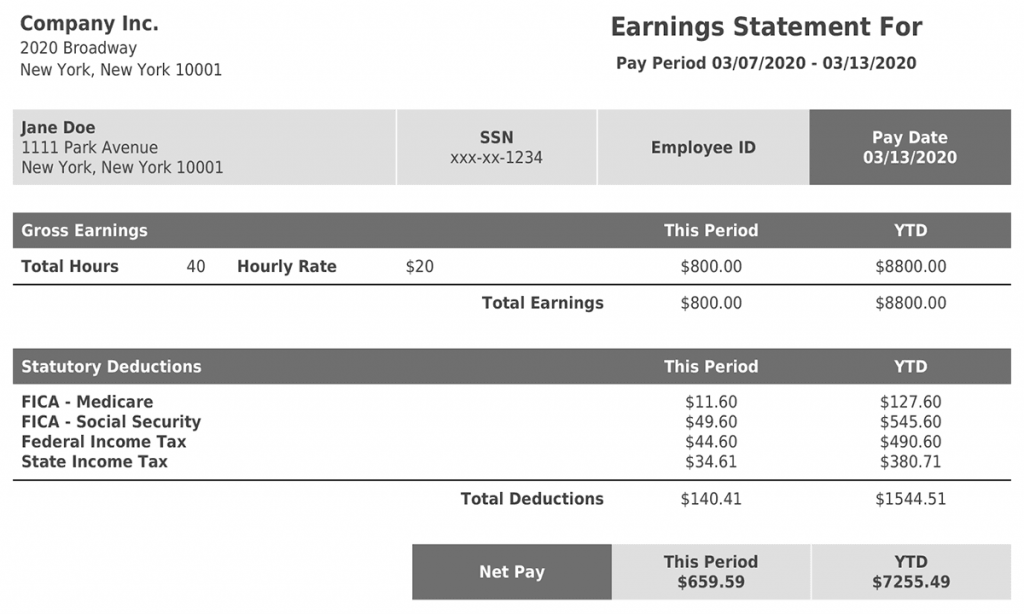

In this guide, you’ll learn everything you need to know about pay stubs, including the essential details required to create one and a step-by-step example of a pay calculation. We’ll also explore why relying on spreadsheets for payroll can lead to costly mistakes—and how FormPros’ online pay stub generator offers a faster, more reliable solution.

Table of Contents

What is a Pay Stub?

A paystub lists all of the key information related to an employee’s pay.

When you review a pay stub, it’s important to note the difference between current (current pay period) and year-to-date (YTD) amounts. Both are important, and the YTD balances help the employer and the worker understand if the amounts are correct.

The pay stub provides information on wages, tax withholdings, and benefit withholdings.

The rules regarding pay stubs vary by state. Some states require employers to provide pay information to workers, while other states do not.

States That Require Employers to Provide Pay Information:

| California | Requires pay scales to be provided upon request. |

| Colorado | Employers must include salary ranges in job postings. |

| Connecticut | Requires disclosure of wage ranges upon an employee’s request or when a job offer is made. |

| Maryland | Employers must disclose salary ranges upon request. |

| Nevada | Employers must provide wage or salary range after an initial interview or upon request. |

| Rhode Island | Employers must provide salary ranges for positions upon request. |

| Washington | Requires employers to provide wage information upon request after an offer of employment is made. |

| New York (NYC) | New York City employers must include salary ranges in job postings. |

| Massachusetts | Employers must provide wage information upon request. |

Most other states do not have explicit statewide requirements mandating employers to provide wage or salary information to employees or job applicants, though local laws (such as in certain cities) may vary. This is based on general wage transparency laws and could change, so it’s always good to check local regulations for specific requirements.

Employees should keep their most recent pay stubs as proof of income. If an individual applies for a loan, the pay stub confirms the borrower’s gross income. Employers should keep pay stubs on file, whether generated manually or using a check stub generator for accuracy and compliance.

The pay stub information should match the data on each employee’s W-2 form, which individuals use to file their personal tax returns. FormPros can help with that as well.

Working with Form W-4

The Employee’s Withholding Allowance Certificate (Form W-4) is a form that the federal government requires employees to fill out when they are newly hired. Information submitted on the form (allowances) lets employers know how much salary to withhold from a paycheck for tax purposes.

Keep these points in mind:

- As an employer, you should keep a worker’s most current W-4 form in his or her payroll file. The IRS may request a copy of the form.

- You need to make sure that you add the correct number of allowances into your payroll processing system.

The W-4 collects the worker’s basic information (name, address, filing status) and provides guidance for employees who have multiple jobs, or who have working spouses. There are extra resources provided to calculate withholdings for these situations.

Once you have a completed W-4, you’ll need to collect additional information for the paystub. A paycheck stubs generator can help automate this process, reducing the chance of manual input errors.

Information Needed to Create a Pay Stub

Determine this information for each employee:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Here’s a simple example to illustrate how to calculate net pay using a paycheck generator:

Sally’s annual income is $60,000, and your firm processes payroll 26 times a year. Sally’s gross wages each pay period total ($60,000 / 26), or $2,308 per pay period.

Based on the allowances on her W-4, your company should withhold 20% of her gross pay ($462) for federal taxes, and 5% ($115) for state taxes. Sally also pays $50 each pay period for her share of the company health insurance plan.

Sally’s net pay is $2,308, less a total of $577 ($462 + $115) for taxes, and $50 for her health insurance premiums. Her net pay is $1,681 ($2,308 – $627).

The online paystub generator must include all of this information for the current payroll period and year-to-date. The pay stubs you generate may also include unemployment tax payments. Hourly workers need details on their total hours worked, and any hours that are paid as overtime wages. A pay stub generator ensures that all of this information is accurately recorded for both the employer and employee, reducing errors and improving record-keeping.

Why Spreadsheets Are a Problem

Using manual processes increases your risk of error, and a manual system limits your ability to scale the business. Here are several reasons why:

- Input errors: You run a high risk of making an input error. If you’re creating manual pay stubs each pay period, you’re bound to make a mistake.

- Broken, incorrect links: Links between cells, and links between spreadsheet tabs, may have errors. If you use an incorrect formula over and over for months, you’ll generate multiple errors.

- Current version: You may not use the current version of a particular spreadsheet. It’s also more difficult to save and use the current version of a document.

Incorrect pay stubs have a big impact on your workers. They rely on pay stubs to understand their total pay and tax withholdings. If you report bad information, your workers can’t plan correctly, and they may file incorrect tax returns.

These problems can be avoided by switching to a paystub generator online, which simplifies payroll processing and improves accuracy.

Automate Payroll with an Online Pay Stub Generator

Instead of handling payroll manually, take advantage of a check stub generator to streamline operations. By using FormPros’ paycheck generator, you can:

- Minimize payroll errors

- Improve record-keeping and compliance

- Save time by automating repetitive tasks

Enjoy the simplicity and security of our online paystub generator below!

FormPros Has You Covered

Simplify your paperwork with FormPros! From our paycheck stub generator, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Why Use an Online Paystub Generator? FAQs

-

What should I do if an employee notices an error on their paystub?

If an employee points out a mistake on their paystub, you should review the payroll records promptly and recalculate the figures. If it’s a genuine error, issue a corrected stub and, if necessary, a back payment. Always document the correction for compliance and future audits.

-

How long should businesses keep employee paystubs on file?

Employers should keep paystub records for at least four years. This duration helps ensure compliance with IRS requirements, wage and hour laws, and potential disputes over compensation or benefits.

-

Can pay stubs be used to verify employment history?

Yes, pay stubs can support employment history by showing the employer’s name, payment dates, and job-related earnings. However, for formal background checks, third-party verification or additional documents may still be required.

-

Are electronic paystubs legally valid in all states?

Most states accept electronic paystubs as long as employees have easy access to them. Some states require consent before switching from paper to digital. Always check your state’s labor laws to ensure compliance.

-

Do freelancers or gig workers need pay stubs too?

Yes, while not required by law, pay stubs can help freelancers prove income for things like loan applications or rentals. Many use online paystub generators (like FormPros) to create professional records for self-employment income.