W-4 vs W-2 Forms: A Definitive Guide for Employers

To avoid unwanted Internal Revenue Service (IRS) penalties, it’s important that employers complete W-4 and W-2 forms at the end of each tax year.

However, knowing what each form’s requirements are and the difference between a W4 and W2 can be challenging. This is especially true for a small business without a large payroll department.

This article will explain why W-4 and W-2 forms are necessary. By the end you will know how to identify and complete each one, and what the options are for submitting them on time.

The Basics of W-4 and W-2 Forms

Once business owners know what W-4 and W-2 forms are, understanding their differences and filling them out becomes much easier.

But whats the difference between W2 and W4? Let’s take a closer look at the basics of each of these tax forms.

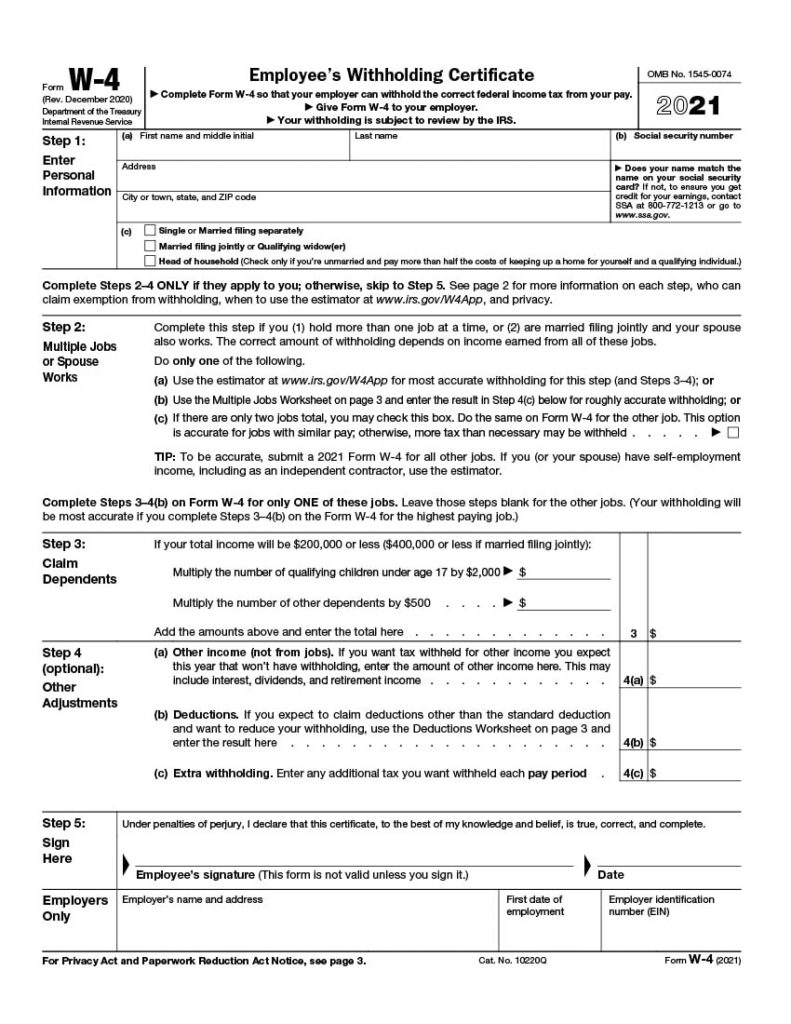

Form W-4

Also known as the “Employee’s Withholding Allowance Certificate,” the W-4 is a form that the federal government requires employees to fill out when starting a new job.

For an employer’s purposes, an IRS Form W-4 is used to determine the amount of income tax to withhold from an employee’s paycheck. The difference between a W4 and W2 lies in who fills them out—employees complete Form W-4, while employers complete Form W-2.

It’s important that the information on the Form W-4 is accurate. If the incorrect amount is withheld from your employee’s paycheck, they could face expensive tax bills or penalties at the end of the tax year.

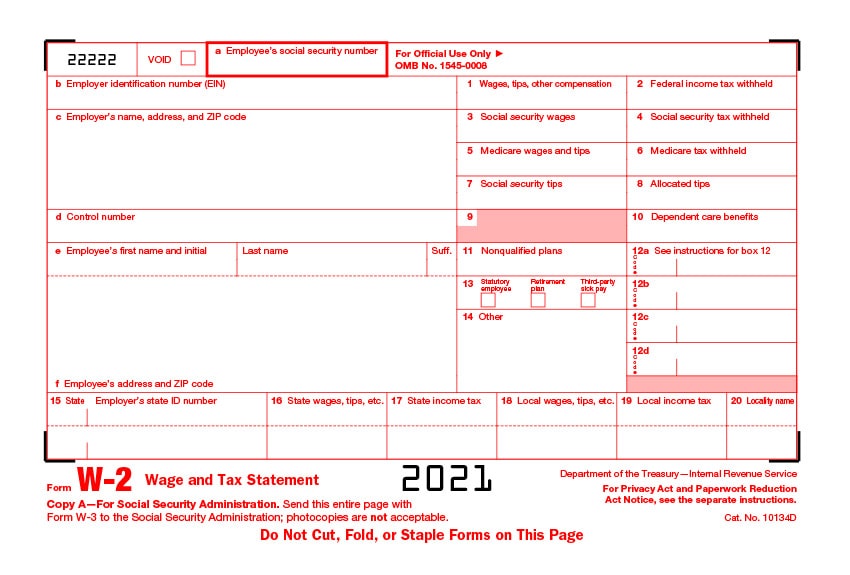

Form W-2

This IRS form is also known as a “Wage and Tax Statement.” Employers are required to complete and distribute this form to their employees by the end of the tax year. The W-2 form is a document that outlines how much an employee was paid during the year and how much income and federal tax was withheld.

For each employee that is paid at least $600 in wages, employers must file a copy of the Form W-2 with the Social Security Administration (SSA). Unlike Form W-4, which employees submit to their employer, Form W-2 is sent to both the employee and government agencies. This is a key difference between W2 and W4.

We’ll go into more detail about what these withholding allowances are later in the article. This form should be submitted with your employee’s tax return. Otherwise, the IRS will not accept the tax return as valid.

W2 vs W4 Forms: Understanding the Differences

Now that you know what these IRS forms are, we can outline the key difference between a W4 and W2 and how they relate to business owners. It’s crucial to remember that the main difference between these tax forms lies in their purpose and who fills them out.

What are the purposes of these forms?

— While Form W-4 is completed by employees, it carries significant implications for employers as well. This form determines how much tax should be withheld from an employee’s paycheck, directly affecting payroll processes.

— Employees must submit a new Form W-4 whenever their financial situation changes. This could include starting a new job, getting married or divorced, having a child, or receiving a pay raise. These changes are important for employers because they can impact the amount of payroll taxes withheld throughout the year.

— Employers are generally not required to complete any sections of Form W-4, except in cases where state laws mandate new hire reporting. Once completed, employers should retain the form in case the IRS requests a copy for verification.

On the other hand, Form W-2 is entirely the employer’s responsibility. The W2 form vs W4 form distinction becomes clear when you consider that W-2 reports wages and taxes withheld, while W-4 is used to calculate withholdings.

A W-2 form should include:

- The employee’s gross pay.

- Any bonuses or tips received.

- Federal income tax contributions, including Medicare and Social Security taxes.

- Additional withholdings, such as retirement plan contributions.

Employers must compile this information and submit it to both the Social Security Administration (SSA) and the IRS to ensure accurate tax reporting for each employee.

What is the deadline for submitting W-4 and W-2 forms?

Another difference between W-4 and W-2 forms is their submission deadlines.

Form W-4 Deadline –

- There is no official IRS deadline for submitting Form W-4, as it is completed by employees and kept on file by the employer. However, employers must ensure they implement an employee’s withholding changes by the first payroll period ending on or after 30 days from receiving a new W-4 form.

Form W-2 Deadline –

- Employers must submit Form W-2 to both the IRS and Social Security Administration (SSA) by January 31st of the following year. Employees must also receive their W-2 forms by this date to file their tax returns on time. If January 31st falls on a weekend or holiday, the deadline moves to the next business day.

The table below summarizes the W4 form vs W2 differences:

| W-4 Form | W-2 Form |

| Employees fill out Form W-4. | Employers complete the form on behalf of their staff. |

| The purpose of this form is to inform employers of how much income tax to withhold from employees. | The W-2 form is used to report how much an employer-paid each employee and the amount of income tax withheld during the tax year. |

| W-4 forms should be submitted to employers within the first month of starting a new job. | Employers must complete and distribute a copy of the Form W-2 to their staff by January 31 of each calendar year. |

| Employers are recipients of W-4 forms. | W-2 forms are intended for employees and the IRS and SSA. |

| The Form W-4 is submitted each time an employee starts a new job or needs to report changes to their financial situation. | The Form W-2 is submitted only once, at the end of the tax year. |

How Do Employers Fill Out W-4 and W-2 Forms?

IRS forms can be lengthy and intimidating at first glance. However, if you know what information is needed to complete W-4 and W-2 forms, the process is much easier.

Form W-4

Employees that are single (or married to an unemployed spouse), have no dependents and claim only one income, only need to include the following information on an IRS Form W-4:

- Full name and address

- Social Security number

- Marital status

- The employment commencement date

The employer will then need to enter their full name, address and their Employer Identification Number (EIN). Employees can also expect an additional three pages on the Form W-4. These include:

- The Personal Allowances Worksheet

- Deductions, Adjustments and Additional Income Worksheet

- Multiple Jobs Worksheet

If the employee has more than one job, a working spouse or dependents, filling out a W-4 form can be slightly more complicated….

Multiple jobs or a working spouse —

Employees that have more than one job or whose filing status is “Married filing jointly” can complete their IRS Form W-4 in a few different ways.

If the employee has two jobs, or if the spouse and the employee each have one job, the first line of the “Multiple Jobs Worksheet” must be completed. Both the employee and their spouse must ensure that they both fill out a W-4 form with their respective employers.

Employees with more than two jobs between themselves and their spouse have to complete sections 2 to 4(b) on the W-4 form for the highest paying job. The W-4 form also comes with a worksheet to guide employees on how to use the salaries from their lower and higher-paying jobs to calculate the amounts to add to each line on the document.

Dependents —

It’s important for employers to note that if their employees have dependents they may be eligible for the Child Tax Credit. The eligibility requirements are that a single taxpayer must either be earning less than $200,000 or making less than $400,000 as a married couple filing jointly.

Employees would then multiply the number of dependents they have by the Child Tax Credit amount and add the amount to line three on Form W-4.

If the employee has other dependents, it’s their responsibility to review who the IRS considers as dependents to ensure this section is completed accurately.

Additional Withholdings —

After employees fill out the essential information on their W-4 form, they can also specify if they want any other money withheld from their paycheck.

A good example is when an employee expects to earn income that is not subject to tax deductions. On the IRS Form W-4, these sections are:

- 4(a): This section should be completed if the employee expects to earn “non-job” income that is not subject to tax withholdings.

- 4(b): Employees should fill out this section if they expect to claim deductions and want to reduce their withholdings.

- 4(c): This section must be filled out to specify whether the employee has any other additional income they want to be withheld from each paycheck.

Before the employee can submit their W-4 form, they must sign and include the date to ensure the document is valid.

Form W-2

When employers fill out W-2 forms, they need to include the company’s name, address and state-specific tax number. Additionally, the Form W-2 requires the following basic information about the employee:

- Full name, address, and Social Security number

- Gross pay

- Federal Income Tax

- Social Security Tax

- Other compensation such as bonuses or tips

Although W-2 forms are fairly straightforward to complete, there are a few common mistakes which employers should avoid. Not only can errors on the W-2 form cause confusion for employers and employees, but these mistakes can also be penalized.

Common mistakes to avoid include —

- Filling out a W-2 form that is outdated and from the previous year

- Completing the form with incorrect employee name and Taxpayer Identification Number

- Using titles and abbreviations in the name fields of a Form W-2

- Missing the IRS filing deadline

- Not using black ink to fill in the form

- Omitting your EIN

- Failing to complete the employee’s “Retirement plan or Medicare wage” section.

Both employers and employees should ensure that the income tax withholdings on the Form W-2 are accurate to avoid expensive tax bills.

Taking a closer look at penalties —

In the event a taxpayer does not fulfil their tax obligations, they could be subject to a penalty with the IRS. This means it’s important for both employers and employees to be aware of the different types of penalties and how to avoid them.

There are a few reasons why penalties might be owed. Here are some of them:

- The taxpayer does not file their tax return on time

- Information on the tax return is incorrect

- The individual pays their tax return in the wrong way

The IRS may also charge interest on a penalty if the taxpayer does not pay the total amount. Additionally, it may charge some penalties every month until the full amount is paid. When the IRS issues a penalty, they will inform the individual by letter or mail. This notice will outline the penalty, the reason for it and how to resolve it.

What Happens After The W-4 and W-2 forms Are Filled Out?

Once these IRS forms have been completed, the next step is to file them electronically or send physical copies by mail. Let’s take a closer look at what each of these options entails and their pros and cons.

E-Filing:

This process involves filing tax returns over the internet via the Electronic Federal Tax Payment System (EFTPS).

One of the main benefits of e-filing is that it processes returns much faster than mail submissions. Not only are returns processed within a day or two, but the IRS also sends people instant confirmation when their forms have been received.

With e-filing, there is also less chance of human error. This is because the IRS does not have to manually enter your return into the system. The tax software used by the IRS completes the calculations, flags errors and will let taxpayers know if they have missed any important information.

Although e-filing is efficient, there are a few limitations. Individuals cannot use the e-filing system if:

- Additional statements or images are attached to the return

- The return is for someone who has passed away

- The IRS has not opened the filing system for the year

Paper Filing:

For those who prefer not to use technology, paper filing works just as well as electronic submissions.

This method also allows taxpayers to be much more thorough when completing their tax returns. The paper filing gives the individual the opportunity to review all the details of their tax return and see the calculations first-hand.

Many taxpayers also find paper filing more secure because they do not have to upload any of their personal information onto the internet. Although the IRS has security measures to prevent data breaches, paper filing has less chance of ending up in the wrong hands.

On the other hand, mail submissions take longer to process. Taxpayers can wait up to six weeks to receive refunds after their returns have been processed. There is also a greater chance of errors in processing paper tax returns because the IRS manually transcribes data in the system.

Paper filing can also be quite daunting for beginners because various forms need to be gathered and submitted with the return.

Filing Extensions:

Whichever submission method you choose to use, it’s important to request a filing extension if you are unable to meet the deadline to avoid late penalties.

To request an automatic extension, taxpayers must use Form 4868.

The extension allows you more time to file your tax returns, but keep in mind that the tax payment is still due by April 18th.

Say Goodbye to W-4 and W-2 Form Guesswork

Understanding the difference between a W4 and W2 is crucial for both employers and employees. By ensuring these forms are completed correctly, businesses can avoid IRS penalties, and employees can ensure accurate tax withholdings.

If you’re still wondering, “What’s the difference between W-2 and W-4?”—simply remember:

- Form W-4 is filled out by employees to set their withholdings.

- Form W-2 is filled out by employers to report earnings and withholdings.

Using a form generator like FormPros can simplify the process, ensuring accuracy and compliance with IRS regulations.

1) Employee Is Hired by EmployerEmployer inputs employee info into the payroll system, including hire date and pay rate. |

2) Employee Completes IRS Form W-4Employer adds data into payroll system from employee’s W-4 Employee’s Withholding Allowance Certificate. |

3) Employee Works & Gets Paid During the YearEach pay period employer provides wages and deducts and pays taxes based on the W-4 withholding data. |

4) Employee Receives W-2 at Year EndOn or before Jan 31, employer provides IRS and all employees their year-end W-2: Wage and Tax Statement. |

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

We Can Help You!

- Saves time and headache

- Easy to follow steps

- Preview and share easily

- Preview pre-purchase