Get Your Printable W-2 Form in 3 Easy Steps

-1-

Fill W2 form online: enter employer and employee details.

-2-

Get a free consultation to save tax (optional).

-3-

Download your printable W-2 Form.

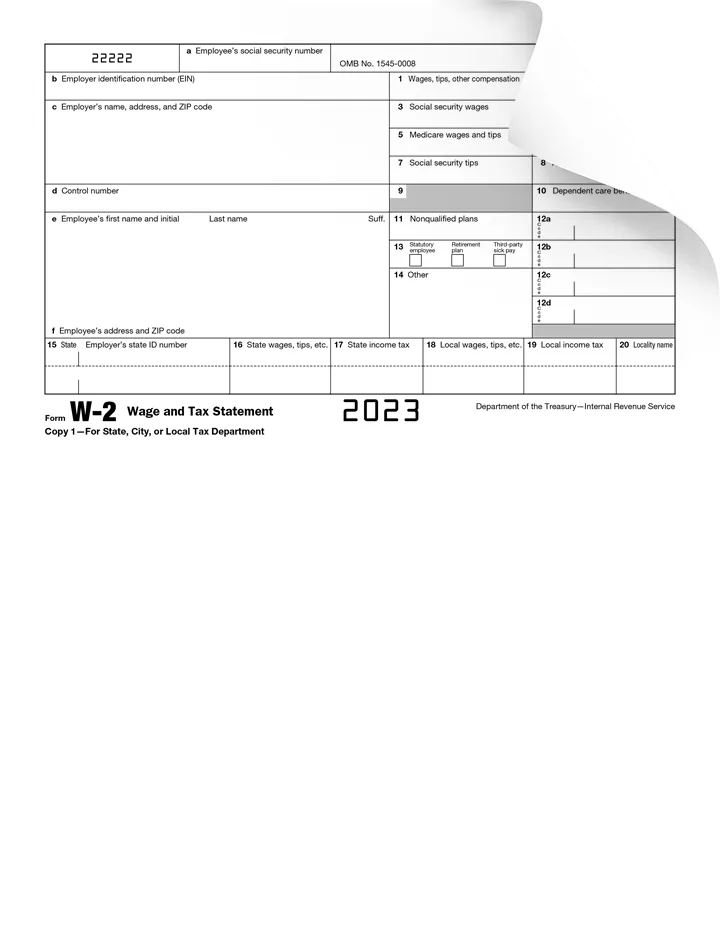

What is a W-2 Form?

Form W-2 requires employers to report employee wages, salaries, and tax withholdings to the IRS, including federal, state, and other deductions. It may also include employer-provided benefits like health insurance, adoption and dependent care assistance, health savings account contributions, and more. If you’re wondering “how can I get my W2 online for free,” there are several digital solutions available to access or generate your W-2.

For Employers: In addition to the IRS requirements above, employers also need to file a copy of the W-2 online with the Social Security Administration (SSA) by the end of February.

For employees: Employees need this form to file their federal and state taxes. Without it, the IRS will not accept an individual’s income tax return as valid. If you worked as an employee during a given year, you should receive a W-2 online from your employer near the beginning of the following year and no later than January 31st, which is crucial for preparing your tax return.

Take the Guesswork Out of W-2 Form Creation

As a business owner during tax season, in addition to doing your personal and corporate 1040s, you also need to distribute information to your employees via W2 form printable – so that they can complete their tax forms.

Don’t let this paperwork overwhelm or discourage you.

Our fillable forms make it simple to generate and print out W2 form templates for your employees. All you need is basic employment and salary information. Our W2 generator tool calculates the state and federal tax withholdings for you automatically.

*Keep in mind that Copy A of this form is provided for informational purposes only. Copy A appears in special red ink, similar to the official IRS form. FormPros cannot replicate this ink therefore if you need paper copies, you must order them from the IRS, fill them out, and mail them back. Do not print and file Copy A from either this website or the IRS website.*

W-2 in a Nutshell

Employers must complete and distribute the W-2 online form to their employees by January 31st each year.

Employers also need to file a copy of the form with the Social Security Administration (SSA) by the end of February. The SSA uses that information to determine future social security, disability, and Medicare benefits.

Printable W-2 forms differ from W-9 and 1099 MISC forms, which are often confused with them. A W-9 form is the form employers have independent contractors fill out at the time of hire. That form contains all the information an employer needs to complete IRS 1099 MISC forms.

The 1099 MISC form is the equivalent of a W2 form template for independent contractors. It reports the amount a contractor earned in a given tax year.

Why Do You Need to Use the W-2 Form?

As an employer, you need a W2 template to inform the government how much you have paid to and withheld from each employee. The form also gives employees the information they need for their income tax return.

For example, how much you have added to your retirement plan, your social security and medical earnings, and even any amount you received for your health insurance. It gives the Social Security Administration and the Internal Revenue Service a clear picture of your income tax returns.

When Do You Need the W-2 Form?

Your current or former employers must send you the W-2 Form for the previous year by the end of January. If you don’t have one or can’t get it from your previous employer, you may be asking, how can I get my W2 online for free? In such cases, you will need to create a W-2 form by yourself using a W2 generator.

Are there any deadlines or times when this form is needed?

Employers must complete and distribute Form W-2 to employees by January 31st. They must also file Form W-2, along with Form W-3, with the Social Security Administration (SSA) by the same date, whether filing electronically or by mail.

Missing the deadline may lead to late filing penalties. If January 31st falls on a weekend or national holiday, the deadline moves to the next business day.

What Are The Main Things That Go on a W-2 Form?

A W2 template reports an employee’s annual earnings and tax withholdings. Employers must provide this form to their employees and the IRS at the end of each tax year. The form includes several key pieces of information:

- Employer Information:

- Business Name

- Business Address

- Employer Identification Number (EIN)

- State Tax ID Number (if applicable)

- Employee Information:

- Full Name

- Address

- Social Security Number

- Earnings and Tax Information:

- Total Wages, Tips, and Other Compensation

- Social Security Wages and Medicare Wages

- Federal and State Income Tax Withheld

- Social Security and Medicare Taxes Withheld

- Retirement Plan Contributions (if applicable)

- Other Benefits or Deductions (e.g., health insurance, dependent care benefits)

What are the Most Common Mistakes to Avoid?

Mistakes made on Form W-2 can create confusion for both employers and employees, leading to delays in tax processing, incorrect tax filings, and even potential penalties from the IRS. Employers must take extra care to ensure all information is accurate and compliant with IRS guidelines. Below are the most common mistakes to avoid when completing Form W-2:

1) Using a Form from the Wrong Year

- Each tax year has a specific W-2 form version, which includes updates to tax rates, wage bases, and reporting requirements. Using an outdated form can lead to incorrect reporting and IRS rejection.

2) Incorrect Employee Names and Social Security Numbers (SSN)

- The name and SSN entered on the W-2 must match exactly as they appear on the employee’s Social Security card. Any misspellings, missing middle names, or incorrect numbers can cause delays in tax filings and Social Security earnings records.

3) Using Titles and Abbreviations in Name Fields

- The IRS requires names to match legal documents exactly. Exclude titles like ‘Dr.,’ ‘Mrs.,’ or ‘Jr.’ unless they are legally part of the employee’s name.

4) Missing the Filing Deadlines

- Employers must file W-2 forms with the IRS and provide copies to employees by January 31st each year. Late filings can result in penalties ranging from $50 to $570 per form, depending on how late the submission is.

5) Failing to Use Black Ink

- Forms should be printed using black ink and should not be handwritten. The IRS uses optical scanning technology, and failing to use the correct ink may lead to processing errors or rejections.

6) Missing Employer’s Identification Number (EIN)

- The EIN is a crucial identifier for the IRS and Social Security Administration (SSA). Omitting or entering the EIN incorrectly can cause delays in tax processing and may require the employer to file corrections later.

7) Failure to Complete the “Retirement Plan” or “Medicare Wage” Block

- If an employee participates in an employer-sponsored retirement plan, such as a 401(k), check the appropriate box. Report Medicare wages accurately, even if no Medicare tax was withheld. Errors or omissions can impact the employee’s tax deductions and Social Security benefits.

Additional Mistakes to Avoid:

- Misreporting Wages and Tax Withholdings – Ensure all earnings, including bonuses, overtime, and benefits, are accurately reported.

- Submitting Poor-Quality Forms – Forms must be clear, legible, and without smudges to prevent processing delays.

- Not Keeping Copies for Records – Employers should retain copies of W-2 forms for at least four years for compliance and auditing purposes.

Do I need to use a lawyer, accountant, or attorney to help me?

When it comes to taxes, you can do it yourself. Most often, businesses rely on tax professionals like lawyers or legal attorneys to take care of the tedious details of tax and other legal needs. But these legal entities can cost you much.

You can save your time, stress as well as money by downloading the form online. There are several web-based software that allows you to download W-2 forms easily and safely. If you opt to access your W-2 online, you have to download and print your own copies. It’s a simple and easier process that eliminates the waiting time for paper copies.

Why use our W-2 Form Generator?

Our tool is the simplest, easiest, and the most advanced W2 generator tool that can help you create a W2 online in less than 2 minutes. It will be automatically filled with correct calculations and ready to be sent to your employees. FormPros also has a subscription plan so you can create unlimited W2 templates at a low cost.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-4’s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Form W-2 FAQs

-

What is an IRS Form W-2?

As an employee, you will receive a W2 tax form from your employer , which is a crucial document for your tax records. This form reports to the IRS the total amount you were paid during the year and how much was withheld from your salary including Social Security, Medicare taxes, or any other contributions for that year. Your employer is responsible for creating and filing the W2 tax forms and must provide you with a copy. You will also use this form when preparing and filing your own tax returns.

-

Who needs a W-2 tax from?

Form W-2 is needed by employees whose employers have withheld some amount from their salary for tax purposes. They will need to attach it to their own tax returns when they file them.

Employers also need to make and file one W2 for every employee they paid more than $600 or its equivalent or from whose salaries they have withheld amounts for taxes.

-

What are the deadlines for filing W-2?

To ensure timely filing of your W-2 forms, keep these critical dates in mind:

- January 31 - The deadline to provide your employees with their W2 copies.

- January 31 - The deadline for employers to file the paper copy of form W2 (Copy A). Take note that Form W3, which summarizes the W2 information, must also be filed.

- January 31 - The deadline for employers to electronically submit Copy A of Form W-2.

-

What are the main things that go on a Form W-2?

It mainly contains the following:

- Details to identify the employer and the employee such as identification number;

- How much the employer has paid to the employee;

- The amount that the employer has withheld from the employee's salary for purposes such as

- Medicare tax

- Federal income tax withheld

- Charitable contributions

- Payroll taxes

-

How to create W-2 for employees?

To make a W-2 for employees, you can either download and print the W-2 Form from the IRS website or use a W-2 Form generator from a reputable W2 form-maker such as FormPros.

With FormPros, no PDF editing software is required. Just answer a few simple questions about employer and employee, then download, print, and mail the copies.

- For companies with 250 employees and below, W2 Form filing can be filled out by hand and submitted via mail.

- For companies above 250, the W2 Form must be done electronically.

-

Can I create a W-2 online?

Yes, you can create a W-2 form for your employees online. Our W-2 generator is perfect for this, as we’ll guide you through the steps to make sure you don’t miss anything. After answering a few questions, you’ll only need to download, print and file filled copy of the form by mail. Consult IRS website if you want to file Form W-2 electronically.

-

Where can I get a copy of my W-2?

You can get it from your employer who is actually required to give you a copies every year to be filed with your Federal and State tax return, as well as a copy for your personal record keeping. Sometimes employers have payroll providers. If your employer has one and is unable to give you a copy of your W-2, the payroll provider might.

-

Can you get another W-2 if you lost it?

Yes, you can get another W2 if you lost it - simply ask your employer for another copy. The employer is required to provide it to you. If you your employer fails to give you one and it’s past January 31st, you can ask IRS for help in compelling your employer to do so. You can also get copies of older W-2 tax forms you submitted with your tax return for previous years from the IRS website.

-

How to get W2 from your previous employer?

To obtain your W-2 Form from your previous employer, follow these steps:

- Reach out to your previous employer: Contact the HR or payroll department of your previous employer because they are typically responsible for issuing W-2 forms. Provide them with your contact details and mailing address where they can send the W2 form.

- Request for a digital copy: If the employer has an online system for payroll and tax documents, ask if you can access your W-2 electronically.

- Contact the IRS: If you still haven’t received your W-2 after reaching out to your employer, you may contact the IRS for assistance after February 15th. You'll need to provide your personal information, the employer's details, and the estimated wages and taxes withheld.

-

How can I get a copy of my W2 online?

- Check with your employer: Your former employer may have an online portal where past tax documents are stored. Contact them and ask if you can access your old W-2 electronically.

- IRS "Get Transcript" tool: Visit the IRS website and use the "Get Transcript" tool. You can request a "Wage and Income Transcript" that will show data from your W-2s for the past 10 years. Note that this transcript will not be an actual copy of your W-2, but it will have the necessary information.

- Tax preparation services: Some online tax preparation services may keep records of your past filings if you've used them before. Log into your account to see if your old W-2s are available.

-

How to find Employer Identification Number (EIN) without W2?

- Contact your employer: Reach out to your employer's HR or payroll department directly and request the EIN. This is often the simplest and quickest way to get the information.

- See your past W2 forms: If you've filed taxes in previous years and used your employer's EIN, this number should be on those documents. Look at your prior year's tax return if you've filed electronically or kept copies.

- Look at other tax forms: If you've received other tax-related documents from your employer, such as Form 1099 or end-of-year pay stubs, the EIN might be listed there.

-

What is Adjusted Gross Income on W2?

As an employee, your Adjusted Gross Income (AGI) or Net Income is calculated by subtracting the income adjustments from your total gross income. Gross income includes your wages, dividends, capital gains, business income, retirement distributions, and other allowable deductions.