What is the official name of Form 1099-DIV and what is its purpose?

The official name of the form is Form 1099-DIV, “Dividends and Distributions.” Its purpose is to report dividends and distributions received during the tax year by investors. These payments come from investments in banks and other financial institutions.

This includes information about dividends, distributions from mutual funds, capital gains dividends, and non-dividend distributions. It also covers federal income tax withheld, foreign taxes paid, and foreign source income.

This form helps the Internal Revenue Service (IRS) ensure that all dividend income is accurately reported and taxed appropriately. It must be included on individual federal income tax returns. Understanding the 1099-DIV instructions ensures accurate completion of this form and compliance with IRS guidelines.

Why is Form 1099-DIV important?

Form 1099-DIV is crucial because it enables accurate reporting and taxation of all dividend and distribution income received by investors. These payments come from banks and financial institutions. This form provides essential details to the IRS, such as the amount of dividends, distributions from mutual funds, capital gain dividends, and more.

Form 1099-DIV also helps taxpayers properly complete their federal tax returns. It includes details about federal income tax withheld and foreign taxes paid. This ensures they receive credit for taxes already paid overseas and avoid potential underreporting penalties. Essentially, it helps maintain transparency and compliance with IRS regulations. Following the 1099-DIV instructions carefully can help prevent errors and ensure accurate reporting.

Who is required to submit a Form 1099-DIV?

Form 1099-DIV must be submitted by banks, brokerage firms, mutual funds, and other financial institutions. These entities are required to issue this form to any investor who receives dividends and distributions from investments during the tax year.

If dividends or distributions paid to an investor total $10 or more, a Form 1099-DIV is necessary. The same applies if any federal income tax was withheld under the backup withholding rules. This ensures that all taxable distributions are properly recorded, aligning with the IRS’s requirements for the 1099-DIV form.

What are the specific steps to obtain and correctly complete Form 1099-DIV?

To obtain and correctly complete Form 1099-DIV, you should follow these steps:

- First, ensure that you, as the issuer (typically a bank, brokerage, or financial institution), are required to provide a Form 1099-DIV. This form is necessary for any entity paying dividends or distributions totaling $10 or more per year, or at least $600 in certain other cases like liquidation distributions.

- Obtain the official Form 1099-DIV from the IRS website or an authorized IRS distributor. The form can be ordered in bulk if you need multiple copies.

- Gather accurate information for all required fields on the form. This includes the payer’s name, address, and taxpayer identification number, as well as the recipient’s name, address, and Social Security number or taxpayer identification number.

- Fill out the form with details of the dividends paid during the year, including ordinary dividends, total capital gains distributions, qualified dividends, nondividend distributions, federal income tax withheld, investment expenses, foreign taxes paid, and foreign source income.

- Calculate and ensure accuracy in reporting the totals in each box, especially distinguishing between qualified and non-qualified dividends.

- Provide the recipient with Copy B of the completed Form 1099-DIV by January 31st following the tax year in which dividends and distributions were paid.

- Submit Copy A of the form, along with Form 1096 (if filing by paper), to the IRS by February 28th (or March 31st if filing electronically) of the year after the dividends were paid.

- Retain a copy for your records, keeping detailed documentation in case of queries or the need for further clarification from the IRS or the recipient.

By strictly adhering to these steps, you ensure compliance with IRS rules and proper reporting of all dividends and distributions. If you need guidance, reviewing the official 1099 DIV instructions can clarify specific filing requirements and help avoid penalties.

When and how often do you need to file Form 1099-DIV, and are there any associated deadlines?

Form 1099-DIV needs to be filed by banks and financial institutions annually. They must send the form to the investor by January 31st and file a copy with the IRS by February 28th if filing by paper, or by March 31st if filing electronically. These deadlines ensure that taxpayers have the necessary information to report dividend income on their tax returns due typically by April 15th.

Are there any consequences for late submission of Form 1099-DIV?

Yes, there are consequences for the late submission of Form 1099-DIV. The IRS can impose penalties on the entity responsible for issuing the form if it is not submitted by the required deadline. The amount of the penalty depends on how late the form is filed and can range from $50 to $290 per form, with a maximum penalty limit based on the size of the business. Additionally, if the failure to file is intentional, more severe penalties could be applied.

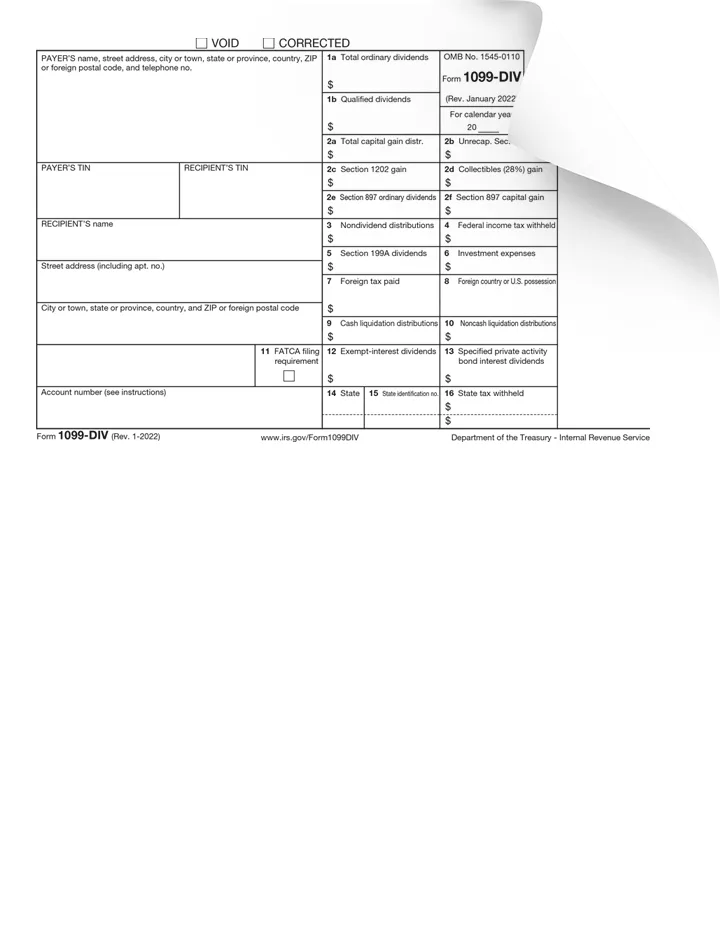

Can you list the key components or sections that Form 1099-DIV comprises?

Form 1099-DIV, “Dividends and Distributions,” is used to report dividends and other distributions to investors. Here are the key components or sections that comprise Form 1099-DIV:

1) Payer’s Information:

- Payer’s Name, Address, and Telephone Number: The name, address, and contact information of the entity issuing the dividends.

- Payer’s TIN: The taxpayer identification number (TIN) of the entity issuing the dividends.

2) Recipient’s Information:

- Recipient’s Name, Address, and TIN: The name, address, and TIN (such as Social Security Number or Employer Identification Number) of the individual or entity receiving the dividends.

3) Account Number (optional):

- An account number may be included if the payer has multiple accounts for a recipient.

4) Box 1a – Total Ordinary Dividends:

- The total amount of ordinary dividends paid to the recipient. These dividends are typically taxable as ordinary income.

5) Box 1b – Qualified Dividends:

- The portion of the dividends in Box 1a that are qualified dividends, eligible for lower tax rates.

6) Box 2a – Total Capital Gain Distributions:

- The total amount of capital gain distributions, which may come from mutual funds or other regulated investment companies.

7) Box 2b – Unrecaptured Section 1250 Gain:

- The portion of capital gain distributions that are unrecaptured section 1250 gains, generally related to real estate property.

8) Box 2c – Section 1202 Gain:

- The amount of gain on qualified small business stock (Section 1202 gain).

9) Box 2d – Collectibles (28%) Gain:

- The amount of capital gain distributions related to collectibles, which are taxed at a maximum rate of 28%.

10) Box 3 – Nondividend Distributions:

- Distributions that are not paid out of earnings and profits. These are usually a return of capital and are not taxable until the basis of the stock is recovered.

11) Box 4 – Federal Income Tax Withheld:

- Any federal income tax withheld from the dividends or distributions.

12) Box 5 – Investment Expenses:

- The portion of dividends that represent investment expenses, which may be deductible.

13) Box 6 – Foreign Tax Paid:

- Any foreign tax paid on dividends, which may be eligible for a foreign tax credit.

14) Box 7 – Foreign Country or U.S. Possession:

- The name of the foreign country or U.S. possession to which the foreign tax was paid.

15) Box 8 – Cash Liquidation Distributions:

- Cash distributions made as part of the liquidation of the company.

16) Box 9 – Noncash Liquidation Distributions:

- Noncash distributions made as part of the liquidation of the company.

17) Box 10 – Exempt-interest Dividends:

- Dividends paid by mutual funds from interest earned on tax-exempt bonds.

18) Box 11 – Specified Private Activity Bond Interest Dividends:

- The portion of tax-exempt interest dividends that are subject to the alternative minimum tax (AMT).

Additional Information:

- Instructions for Recipient: Detailed instructions for the recipient on how to use the information provided on Form 1099-DIV for their tax return.

Each of these components provides specific information necessary for both the payer to report and the recipient to correctly file their tax returns. Accurate completion of each section ensures compliance with IRS requirements and helps the recipient correctly report their income and calculate any applicable taxes.

What documents should I have on hand to help me complete these sections accurately?

To accurately complete Form 1099-DIV, you should have the following documents on hand:

- Brokerage statements or investment account statements that detail transactions related to dividends and distributions received during the tax year.

- Statements from mutual funds, REITs, or other investment entities reporting dividends paid or capital gains distributions.

- Bank statements if your bank account has investment components that pay dividends.

- Previous year’s tax return, which can help verify carryover amounts and ensure continuity in reporting.

- Records of tax withheld at source on dividends, if applicable, to claim any potential tax credit or deduction.

- Documentation or statements detailing foreign taxes paid if you have investments in foreign corporations, necessary for completing the foreign tax credit form if you qualify.

- Any specific transaction confirmations or documentation received during the year for unusual distributions, such as return of capital or non-dividend distributions.

A case study showcasing the importance of Form 1099-DIV.

Consider an investor named Sarah who engages in various investment activities, including owning shares in multiple mutual funds and stocks. Throughout the year, she earns dividends from these investments. At the end of the financial year, as she prepares to file her income tax returns, Sarah relies on Form 1099-DIV, which she receives from her bank and mutual fund companies. This form crucially provides detailed information about the different types of income she received during the year, including ordinary dividends, qualified dividends, and capital gain distributions, as well as any federal income tax withheld and information related to foreign taxes paid and foreign source income.

The significance of Form 1099-DIV in Sarah’s case is evident as it facilitates the accurate and efficient filling out of her tax return. Without the detailed information provided by Form 1099-DIV, Sarah would have difficulty reporting her dividend incomes and capital gain distributions correctly, which could lead to errors in tax calculation or inadvertently omitting income, thus risking penalties from the IRS.

Furthermore, the form’s breakdown of the foreign tax paid allows her to potentially claim a foreign tax credit, thus optimizing her tax liability. Without this form, managing and reporting her investment income accurately would be significantly more challenging, highlighting Form 1099-DIV as an essential tool for individual investors in complying with tax laws and ensuring correct tax reporting.

How do I file Form 1099-DIV?

Form 1099-DIV is typically not filed by the individual taxpayer receiving the dividends but by the bank or financial institution that distributes the dividends. If you receive a Form 1099-DIV, you do not need to file the form itself with the IRS.

Instead, use the information from the form to report the appropriate amounts on your tax return, specifically on Schedule B (Form 1040) if required, and on your Form 1040 tax return. Include details about dividends, distributions, and any taxes withheld as specified on the 1099-DIV in the relevant sections of your return to ensure your dividend income is correctly reported and taxed. If tax was withheld, this can also help you claim a credit for the withholding. Be sure to keep a copy of the 1099-DIV for your records. If you believe the information on the form is incorrect, contact the issuer to get a corrected form.

Are there any specific regulations or compliance requirements associated with Form 1099-DIV?

Yes, there are specific regulations and compliance requirements associated with Form 1099-DIV. Financial institutions must issue this form to any individual who receives $10 or more in dividends and distributions during the tax year. The form must be furnished to the recipient by January 31st following the end of the tax year and filed with the IRS by February 28th if filing by paper, or by March 31st if filing electronically. It’s also required to report any federal income tax withheld, according to backup withholding rules, on these payments.

Additionally, accurate reporting of foreign taxes paid and foreign source income is essential for taxpayers to claim possible tax credits or deductions associated with foreign tax liabilities. Compliance with these regulations ensures that both the IRS and the taxpayer have the correct information for tax processing and auditing purposes.

What resources are available for assistance in completing and submitting Form 1099-DIV (e.g., professional advice, official instructions)?

To assist with completing and submitting Form 1099-DIV, several resources are available. The Internal Revenue Service (IRS) provides official instructions and guidelines on their website, which are detailed and specific to the current tax year. These instructions include details on how to fill out the form accurately and any updates in tax laws or reporting requirements. Additionally, the IRS offers general tax assistance through their website, local offices, and helplines, where professionals can answer more specific questions or concerns.

For more tailored guidance, taxpayers might consider consulting with a certified public accountant (CPA) or a tax attorney, especially if their investment situations are complex or if they are dealing with large amounts or multiple sources of dividends and distributions. Many professional tax preparation services can also assist in filling out and submitting Form 1099-DIV as part of their services. These providers keep up to date with the latest IRS regulations and can provide insightful advice tailored to an individualâs financial situation.

Lastly, tax software often includes support for generating and filing Form 1099-DIV alongside other necessary tax forms. These software programs can be particularly useful as they often integrate with financial institutions directly to import investment data, reducing errors and simplifying the reporting process.

What are some common errors to avoid when completing and submitting Form 1099-DIV?

When completing and submitting Form 1099-DIV, it’s important to avoid common errors to ensure accurate reporting and compliance with IRS requirements. Here are some common errors to avoid:

1. Incorrect Taxpayer Identification Numbers (TINs) –

- Ensure that the TINs for both the payer and the recipient are accurate. Incorrect TINs can lead to reporting issues and potential penalties.

2. Inaccurate or Incomplete Recipient Information –

- Verify that all recipient information, including names and addresses, is accurate and complete. Incomplete or incorrect information can cause processing delays and errors in reporting.

3. Misreporting Dividend Amounts –

- Accurately report the amounts in each box. Misreporting the amount of ordinary dividends, qualified dividends, or other distributions can lead to incorrect tax calculations for the recipient.

4. Incorrect Reporting of Foreign Tax Paid –

- Ensure that the amount of foreign tax paid is accurately reported in Box 6. Incorrect reporting can affect the recipient’s ability to claim a foreign tax credit.

5. Failing to Report Investment Expenses –

- Accurately report any investment expenses in Box 5. These expenses may be deductible and should be reported correctly.

6. Misclassifying Nondividend Distributions –

- Properly classify nondividend distributions in Box 3. These are typically a return of capital and not immediately taxable, unlike ordinary dividends.

7. Inaccurate Reporting of Liquidation Distributions –

- Correctly report cash and noncash liquidation distributions in Boxes 8 and 9. Misreporting these distributions can lead to incorrect tax treatment.

8. Incorrect Calculation of Qualified Dividends –

- Ensure that the portion of dividends that qualify for lower tax rates is accurately reported in Box 1b. Incorrect calculations can lead to tax discrepancies.

9. Failing to File Timely –

- Submit Form 1099-DIV to the IRS and provide copies to recipients by the required deadlines. Late filings can result in penalties and interest charges.

10. Not Filing Electronically When Required –

- If you are required to file 250 or more Forms 1099-DIV, you must file electronically. Failing to do so can result in penalties.

11. Omitting State Information –

- Include any necessary state-specific information if the form is being used for state tax reporting purposes. Some states require additional details or separate filings.

12. Incorrect Filing of Corrections –

- If a correction is needed, ensure that you file the corrected Form 1099-DIV properly. Follow the IRS guidelines for submitting corrected forms to avoid confusion and potential penalties.

13. Failing to Provide Copies to Recipients –

- Ensure that recipients receive their copies of Form 1099-DIV by the required deadline. Failing to provide these copies can result in penalties and may cause recipients to underreport their income.

14. Misreporting Exempt-interest Dividends –

- Accurately report exempt-interest dividends in Box 10. These dividends are not subject to federal income tax but may be subject to state taxes.

15. Ignoring IRS Updates and Changes –

- Stay informed about any changes or updates to IRS forms and reporting requirements. Ignoring these updates can lead to outdated or incorrect filings.

16. Poor Recordkeeping –

- Maintain accurate and detailed records of the dividends and distributions reported on Form 1099-DIV. Inadequate recordkeeping can complicate filing and hinder the ability to provide accurate information.

By avoiding these common errors, you can ensure accurate and timely filing of Form 1099-DIV, minimizing the risk of penalties and ensuring compliance with IRS regulations.

How should you retain records or copies of the submitted Form 1099-DIV and associated documents?

You should retain copies of Form 1099-DIV and any associated documents for at least three years from the date you file your income tax return. If you claimed a loss for worthless securities or bad debt deduction, keep records for seven years. For those who fail to report income and it is more than 25% of the gross income shown on their return, keep records for six years. Always store the documents in a secure, organized manner, ensuring they are accessible if questions arise about the reported amounts or you are audited by the IRS.

How do you stay informed about changes in regulations or requirements related to Form 1099-DIV?

To stay informed about changes in regulations or requirements related to Form 1099-DIV, regularly consult the official IRS website and review the latest updates in the “Forms and Instructions” section.

Additionally, subscribing to IRS newsletters, attending seminars hosted by tax professionals, and engaging with professional tax organizations can provide updated, authoritative information. Consulting a tax professional or a tax advisor familiar with investment taxation can also ensure compliance with the current laws and guidelines.

Are there any exemptions or exceptions to the requirement of filing Form 1099-DIV?

Yes, there are exemptions to the requirement of filing Form 1099-DIV. Typically, this form is not required if the payments made to the recipient throughout the year total less than $10, unless there was any federal income tax withheld. Additionally, tax-exempt organizations, including retirement plans such as IRAs and 401(k)s, generally do not need to issue or receive Form 1099-DIV. Individual taxpayers are also not required to file this form with the IRS; however, they must report all dividend incomes on their personal tax returns.

Are there any penalties for inaccuracies or omissions on Form 1099-DIV?

Yes, there are penalties for inaccuracies or omissions on Form 1099-DIV. If you fail to file a correct form by the due date and cannot show reasonable cause, you may be subject to a penalty. The amount of the penalty depends on when you file the correct form. The penalty ranges from $50 to $280 per form, with a maximum penalty of $3,426,000 per year for large businesses and $1,130,500 per year for small businesses. Further penalties may apply for intentional disregard of filing requirements, which can be at least $570 per form with no maximum limit.

How does Form 1099-DIV impact an individual or entity’s tax obligations?

Form 1099-DIV impacts an individual or entity’s tax obligations by providing detailed information about the dividends and distributions received throughout the tax year. This form reports key financial data such as the amount of ordinary dividends, qualified dividends, total capital gain distributions, and any federal income tax withheld. Each type of income has different tax implications, hence Form 1099-DIV helps ensure that all dividends and distributions are accurately reported on tax returns. This accurate reporting is crucial as it affects how much tax the individual or entity owes.

For example, qualified dividends are often taxed at a lower rate than ordinary income, so correct classification on Form 1099-DIV can lead to significant tax savings. Moreover, the form also includes details about foreign taxes paid and foreign source income, which may qualify the taxpayer for a tax credit or deduction, thereby potentially reducing their overall tax liability.

By furnishing all necessary information about dividend and distribution income, Form 1099-DIV helps taxpayers comply with tax laws and avoid penalties for underreporting income.

Is there a threshold for income or transactions that triggers the need to file Form 1099-DIV?

Yes, there is a threshold for reporting on Form 1099-DIV. Generally, a Form 1099-DIV must be filed by the financial institution for each person to whom they have paid dividends and other distributions on stock of $10 or more. Additionally, if any federal income tax was withheld under the backup withholding rules regardless of the amount of the payment, a Form 1099-DIV is required.

Are there any circumstances where Form 1099-DIV may need to be amended after filing?

Yes, Form 1099-DIV may need to be amended after filing if errors are discovered in the originally reported information, such as:

- Incorrect amounts

- Missing information

- Misclassified types of dividends

Additionally, if the payer later realizes that the previously reported tax withholding amounts or the payer or recipient details were incorrect, an amended form would need to be issued to correct these errors. Amending the form ensures that both the IRS and the recipient have accurate information for tax reporting purposes.

How does Form 1099-DIV affect financial reporting for businesses, organizations, or individuals?

Form 1099-DIV primarily affects individuals rather than businesses or organizations, as it pertains to distributions received from investments. When individuals receive this form, it means they have received dividends or distributions that are reportable and potentially taxable income. The information provided on Form 1099-DIV must be included in the individual’s federal income tax returns.

Specifically, it affects individuals’ financial reporting by helping them and the IRS track how much dividend income was received during the year, ensuring it is accurately reported and taxed. Any discrepancies or omissions in reporting can lead to miscalculations in tax owed, potentially resulting in penalties or audits.

Therefore, accurate and thorough reporting using Form 1099-DIV is crucial for compliance with tax obligations and for maintaining accurate personal financial records.

Can Form 1099-DIV be filed on behalf of someone else, such as a tax preparer or accountant?

Yes, Form 1099-DIV can be filed on behalf of someone else by an authorized representative such as a tax preparer or accountant. This is common practice, especially when professionals are handling financial documentation and tax filing for clients. The representative must have appropriate authorization to act on behalf of the individual receiving the dividends and distributions.

Are there any fees associated with filing Form 1099-DIV?

There are no fees charged by the IRS for filing Form 1099-DIV. However, if you use tax preparation services or software, they may charge a fee for including this form in your tax return. Additionally, if you file electronically, the provider of your e-filing service may have associated costs.

How long does it typically take to process Form 1099-DIV once it’s been submitted?

Form 1099-DIV, being an informational form, is primarily issued by financial institutions to the taxpayer and does not require direct submission by the taxpayer to the IRS. Therefore, the question of processing time typically does not apply to this form in the same way it does for forms filed by taxpayers, such as tax returns. When a taxpayer files their tax return, the information from Form 1099-DIV is included and is processed as part of the overall tax return, which usually takes the IRS about 21 days to process if filed electronically, or up to six weeks if filed by mail.

Can Form 1099-DIV be filed retroactively for past transactions or events?

Form 1099-DIV can be filed retroactively for past transactions if, for example, it was not filed when originally required, or if corrections are necessary. An updated form should be submitted to reflect accurate information for the specified tax year. Note that filing after the deadline might result in penalties or interest charges from the IRS.

Are there any specific instructions or guidelines for completing Form 1099-DIV for international transactions or entities?

Yes, there are specific instructions and guidelines for completing Form 1099-DIV for international transactions or entities. Here are some key points to consider:

Reporting Foreign Tax Paid (Box 6)

- If the recipient has paid foreign taxes on the dividends, this amount should be reported in Box 6. The recipient may be able to claim a foreign tax credit on their U.S. tax return for this amount.

Reporting Foreign Country or U.S. Possession (Box 7)

- Enter the name of the foreign country or U.S. possession to which the foreign tax was paid in Box 7. This helps the IRS verify the foreign tax credit claimed by the recipient.

FATCA Filing Requirement Checkbox

- If you are required to file Form 1099-DIV under the Foreign Account Tax Compliance Act (FATCA), check the box in the FATCA Filing Requirement section. FATCA requires U.S. taxpayers to report specified foreign financial assets and requires foreign financial institutions to report financial accounts held by U.S. taxpayers.

Recipient’s Identification Number

- For non-U.S. recipients, use their U.S. taxpayer identification number (TIN) if they have one. If the recipient does not have a U.S. TIN, you may need to use their foreign TIN. It’s crucial to ensure the correct identification number is used to avoid reporting issues.

Address for Foreign Entities

- For foreign entities, ensure that their address is complete and accurate, including the country name. This ensures that the form reaches the recipient and that the IRS has the correct information on file.

Withholding Requirements

- U.S. withholding agents are required to withhold tax on certain U.S. source income paid to foreign persons, including dividends. The withholding rate is generally 30%, but it may be reduced under an applicable income tax treaty. Ensure the correct amount of tax is withheld and reported.

Use of Form 1042-S for Foreign Recipients

- If dividends are paid to foreign persons or entities, Form 1042-S, “Foreign Person’s U.S. Source Income Subject to Withholding,” may also need to be filed instead of or in addition to Form 1099-DIV. Form 1042-S reports the amount of U.S. source income paid to foreign persons and the amount of tax withheld.

Proper Identification of Beneficial Owners

- Ensure that the correct beneficial owner of the dividends is identified, especially in cases where a financial institution or intermediary is involved. The beneficial owner is typically the person or entity that ultimately receives the income.

Documentation for Treaty Benefits

- To apply a reduced withholding tax rate under an income tax treaty, obtain the necessary documentation from the recipient, such as IRS Form W-8BEN (Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting). Ensure this documentation is accurate and up-to-date.

Compliance with IRS Filing Deadlines

- Ensure that all forms, including Form 1099-DIV and any related forms like Form 1042-S, are filed with the IRS by the applicable deadlines. Provide copies to the recipients in a timely manner as well.

Reporting Currency

- Report all amounts on Form 1099-DIV in U.S. dollars. If dividends were paid in a foreign currency, convert the amounts to U.S. dollars using the exchange rate in effect on the date of payment.

By following these guidelines and ensuring accurate and timely reporting, you can help ensure compliance with IRS requirements for international transactions and entities on Form 1099-DIV. If you have specific questions or complex situations, consulting a tax advisor with expertise in international tax matters is recommended.

What digital tools or software are recommended for generating and managing Form 1099-DIV?

FormPros could be a suitable tool for generating and managing Form 1099-DIV, as we offer customizable templates and features designed to streamline the process. Additionally, popular accounting software such as QuickBooks or Xero often include features for generating and managing tax forms like the 1099-DIV. These tools can automate much of the process and help ensure compliance with tax regulations. However, it’s essential to review the specific features and capabilities of each tool to determine which best suits your needs.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Form 1099-DIV FAQs

-

How do mutual fund distributions reported on Form 1099-DIV affect my tax return?

Mutual fund distributions reported on Form 1099-DIV include ordinary dividends, qualified dividends, and capital gain distributions. These amounts must be included in your taxable income. Ordinary and qualified dividends are reported on Form 1040, while capital gain distributions are reported on Schedule D (Capital Gains and Losses) and possibly Form 8949 (Sales and Other Dispositions of Capital Assets).

-

What should I do if I receive a Form 1099-DIV with incorrect information?

If you receive a Form 1099-DIV with incorrect information, contact the payer (the financial institution or company that issued the form) immediately to request a corrected Form 1099-DIV. Retain documentation of your request and any responses. Use the corrected form when preparing your tax return.

-

How are capital gain distributions reported on this form taxed?

Capital gain distributions reported in Box 2a of Form 1099-DIV are generally taxed as long-term capital gains, regardless of how long you have held your mutual fund shares. They are subject to favorable tax rates compared to ordinary income.

-

Is it necessary to file a separate Form 1099-DIV for each account if multiple accounts are held at the same financial institution?

No, it is not necessary to file a separate Form 1099-DIV for each account if the accounts are at the same financial institution and registered under the same name and TIN. The institution will typically consolidate all dividends and distributions into one Form 1099-DIV for the taxpayer.

-

How do I interpret the information in boxes 6 and 7 related to foreign taxes and foreign source income?

Box 6 reports the amount of foreign tax paid on dividends, which may be eligible for a foreign tax credit on your U.S. tax return. Box 7 indicates the foreign country or U.S. possession where the tax was paid. This information is necessary to claim the foreign tax credit on Form 1116 (Foreign Tax Credit).

-

What steps should I take if I did not receive a Form 1099-DIV but believe I should have?

If you believe you should have received a Form 1099-DIV but did not, contact the payer to request the form. Check your account statements to verify that you received dividends or distributions. If you cannot obtain the form in time, estimate the amounts based on your records and report them on your tax return.

-

How does Form 1099-DIV interact with other tax forms like Form 1040?

Form 1099-DIV provides information that must be reported on Form 1040. Ordinary dividends (Box 1a) and qualified dividends (Box 1b) are reported on Form 1040, lines 3a and 3b. Capital gain distributions (Box 2a) are reported on Schedule D and possibly Form 8949. Foreign tax paid (Box 6) may be reported on Form 1116 if claiming a foreign tax credit.

-

Are dividends received from foreign corporations reported differently on Form 1099-DIV?

Yes, dividends received from foreign corporations are reported on Form 1099-DIV, but the foreign tax paid on these dividends is reported in Box 6, and the corresponding country in Box 7. You may need to file Form 1116 to claim a foreign tax credit.

-

Where can I find the IRS guidelines for the information reported on Form 1099-DIV?

IRS guidelines for Form 1099-DIV can be found in the IRS Instructions for Form 1099-DIV, available on the IRS website. The instructions provide detailed information on how to complete and file the form, including reporting requirements and definitions of the terms used.