What is a Pay Stub?

A pay stub is an itemized record of an employee’s current pay. It includes all earnings for a specific pay period (hourly wages or salary, overtime, tips and commissions) as well as all current and year-to-date deductions, FICA tax, and income tax withholdings.

While most states do not require employers to provide pay stubs to their employees, many institutions still request pay stubs as proof of income and stable employment.

A pay stub is a document from the employer that breaks down an employee’s pay for a specific pay period. The pay stub reports:

- The number of hours the employee worked

- The gross wages that the employee was paid (before any deductions)

- Federal, state, and local taxes withheld from gross pay

- Other withholdings, such as the worker’s share of insurance premiums

- Net pay

The employee should receive a pay stub each pay period.

The pay stub information should match the data on each employee’s W-2 form, which individuals use to file their personal tax returns. To create a pay stub, the first step is to have each employee complete a Form W-4. Once you have a completed W-4, you’ll need to collect additional information for the pay stub.

Who Needs Pay Stubs?

Employers

Employers need to generate pay stubs, because some states require firms to file and issue pay stubs. The total dollar amount of all pay stubs should be compared to the wage expenses and other labor costs in your accounting records.

Employees

For employees, the most important function of pay stubs is record keeping.

- Many institutions require pay stubs as proof of income, even if employers are not required to provide them. Some entities require pay stubs as proof of income when you’re applying for a loan or renting a home or apartment.

- The details about the employer and the worker’s salary prove employment and total income.

- Pay stubs show an employee’s income, taxes paid, and other contributions. As such, it’s useful for someone who is filing his or her tax returns.

Independent contractors, subcontractors

Contractors, by definition, are not employees and do not have taxes withheld from pay. These workers receive 1099s at the end of the year, which verify income received from a client.

A pay stub can help the contractor verify that the dollar amount on the 1099 is correct. If Acme Manufacturing pays you $5,000 for contracting work in 2020, that dollar amount should be listed on the 1099, and on the year-end pay stub. If the amounts don’t agree, contract the client to resolve the problem.

Self-employed

As a self-employed person, you will still find pay stub records extremely useful.

If you’re the owner of a single-member LLC, for example, it’s important to keep track of all payments made from the LLC to your personal bank account. You need to separate your business expenses from personal transactions, so that you can report the correct amount of business profit on your tax return.

Even if you are self-employed, many banks and institutions will still require pay stubs.

Here are some common types of jobs that require and use pay stubs:

- Corporations: Both small and large corporations of all types

- Retailers

- Tradespeople: Plumbers, carpenters, tree service firms, landscapers

- Startup firms

Who Needs to Prove Income Using a Pay Stub?

Employees, contractors, and independent contractors need pay stubs as proof of income and stable employment. Here are some situations that require the information from a pay stub:

- Home or car loan: The income reported on the pay stub supports your ability to repay a loan. If you’re leasing a vehicle, the car dealer will want proof of your income.

- Rental property: Pay stub information helps a landlord confirm your ability to make rent payments.

- Business loan: Contractors and self-employed workers may need business loans, such as a line of credit. The pay stub supports the loan application.

- Disability: If you’re injured and need to file a claim for disability, the pay stub verifies the income you earned before you became disabled. If you file a lawsuit claiming a disability injury, the pay stub information will support your claim of lost income.

- Applying for visas: In some cases, individuals who are applying for visa need pays stubs to verify income.

What Workers Need to Know About Paystubs?

A pay stub contains a large amount of information, and the amount of detail may cause confusion for workers. Here are four issues that each worker must understand:

- Current period vs. year-to-date wages: The pay stub should clearly label wages as either for the current period of year-to-date. The worker must understand the dollar amount of wages paid now, and the amounts earned so far this year.

- Gross wages vs. net wages: The dollars paid to the worker in a particular period are net wages. Gross wages, on the other hand, is the amount of compensation before any deductions. The worker should be able to take gross wages, subtract all withholdings, and calculate net wages.

- Salary vs. hourly wages: Both of these topics are explained in detail below. Workers must understand if gross wages are calculated using an annual salary number, or based on hours worked in a given pay period.

- Pay schedule, number of pay periods: A worker needs to know when payroll is processed, in order to create a personal budget and plan for bill payment. Total number of pay periods in a year depends on how often the worker is paid. For example, if you receive weekly payments – there are 52 pay periods in a year, bi-weekly is 26, semi-monthly is 24 and monthly is 12.

If your pay stub clearly addresses each of these issues, you’ll avoid confusion and get fewer questions from workers.

In addition, if the worker understands how to read a pay stub, the employee may be able to catch errors or potential fraud.

Say, for example, that you submit $1,200 in pay stub gross wages to the bank account, but the bank deposit indicates $1,050 in cash paid. You and the worker can quickly find the difference, so you can investigate.

The Risk of Fake Pay Stubs and How to Detect Them

Fake pay stubs pose significant risks, especially for businesses, landlords, and financial institutions. A fraudulent pay stub can mislead lenders, landlords, or employers, leading to financial loss or security risks. Here’s what to know about the dangers of fake pay stubs and how to spot them effectively:

Why Fake Pay Stubs Are Problematic

- Loan Fraud: Individuals may create fake pay stubs to overstate their income on a loan or credit application, making it seem they have a higher ability to repay than is accurate. This increases the risk of default and financial loss for the lender.

- Rental Scams: For landlords, a fabricated pay stub can make a potential tenant appear more financially qualified than they are, leading to unpaid rent and potential eviction issues.

- Employment Fraud: Some job applicants may use fake pay stubs to meet salary or employment history requirements, which can lead to complications with tax records and payroll accuracy.

How to Spot a Fake Check Stub

To detect a fake check stub, lenders and other recipients should pay attention to specific details, such as:

- Math Errors: Inconsistent numbers or math that doesn’t add up—like incorrect totals, mismatched deductions, or unreasonable year-to-date earnings—are red flags.

- Layout and Fonts: Fake pay stubs often have formatting issues. Look for unusual fonts, inconsistent spacing, or low-quality logos. Genuine check stubs usually have a standard design specific to the employer or payroll software.

- Company Verification: The most reliable way to verify a pay stub is by contacting the employer listed on it. Calling to confirm the individual’s employment status and income details is a direct way to validate authenticity.

Avoiding Fake Pay Stub Issues with Reliable Software

Businesses, contractors, and freelancers can reduce the risk of pay stub errors or fraud by using trustworthy pay stub generation software. FormPros, for example, enables businesses to create accurate, professional pay stubs that meet all payroll compliance standards. By using secure, standardized software, businesses can provide their employees and contractors with authentic, accurate pay stubs while helping lenders and landlords recognize legitimate documents.

You can avoid problems with issuing your own pay stubs by using FormPros software.

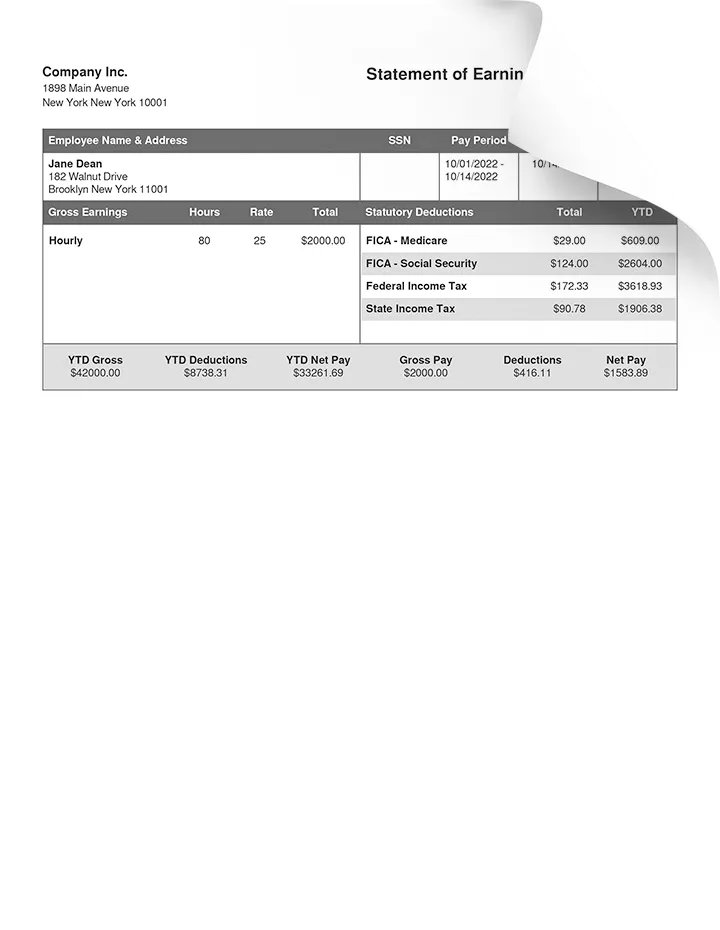

Information Posted to a Pay Stub

While state requirements for pay stubs can vary, pay stubs generally include this information:

- Employer’s company details: business name, address.

- Employee’s personal details: name, address, Social Security Number.

- Payment cycle: The number of pay periods determines how much salary is paid on each payroll date. It also determines the start and ending days for computing hourly payroll.

- Wages: Gross pay and net pay. Wages may be based on a salary, or calculated using an hourly rate of pay.

- Hours worked: hourly rates of pay (straight time, overtime), if applicable.

- Tax withholdings: Federal, state, and possibly local amounts withheld for taxes.

- Benefit withholdings: Amounts withheld for the employee’s share of insurance premiums, or funds to be invested in a retirement plan.

Here are additional details on some important pay stub components:

Gross wages

Wages earned before any withholdings or deductions are subtracted. Gross wages for a pay period amount are calculated in one of two ways:

- Salaried employees: (Annual salary / number of pay periods in a year)

- Hourly employees: (Hours worked X pay rate per hour)

Gross wages may include additional compensation, including sick pay, holiday pay, or bonuses.

Hours worked, pay rate

The hours worked total is particularly important for non-exempt (hourly) workers. The pay stub should include regular hours (up to 40 hours per week), and overtime hours.

The pay stub must detail all hours worked, and the rate of pay earned for each hour. Some workers, including those covered by union contracts, must be paid a specific rate of pay for overtime or double-time hours.

Salaried workers may also see hours listed on their pay stubs.

Tax deductions

Workers determine their federal income tax withholdings amounts by completing Form W-4, and each state has a tax withholding form.

FICA tax is collected to fund Social Security and Medicare. For 2020, the employee tax for Social Security is 6.2% on income earned up to $137,700. The Medicare tax rate is 1.45% on all wages, and high-income taxpayers will pay an additional 0.9% tax for Medicare. The total employee FICA tax rate is 7.65% in 2020.

Employers also pay 7.65%, and the cost is deducted as a business expense. The employer’s payments are typically included on the pay stub.

Benefit deductions

Workers often pay a share of the insurance premiums for company-provided health insurance, and may contribute into a retirement plan, such as a 401(k) plan. 401(k) contributions are made with pre-tax dollars, and the employer may add matching contributions.

Unemployment taxes

Unemployment programs are funded by the FUTA tax (federal) and the SUTA tax (state). These amounts are paid by the employer, but also reported on the pay stub.

Net pay

Net pay is the actual dollars paid to the worker, after all deductions.

Here’s an example of calculating net pay:

Calculating Net Pay

Sally’s annual income is $60,000, and her employer processes payroll 26 times a year (every two weeks). Sally’s gross wages each pay period total ($60,000 / 26), or $2,308 per pay period.

Based on the allowances on her W-4, your company should withhold 20% of her gross pay ($462) for federal taxes, and 5% ($115) for state taxes. Sally also pays $50 each pay period for her share of the company health insurance plan.

Sally’s net pay is $2,308, less a total of $577 for taxes, and $50 for her health insurance premiums. Her net pay is $1,681.

The pay stub must include all of this information for the current payroll period and year-to-date. The pay stubs you generate may also include unemployment tax payments. Hourly workers need detail on their total hours worked, and any hours that are paid as overtime wages.

State Requirements for Pay Stubs

The federal government does not have a pay stub law that all states must follow. However, the Fair Labor Standards Act requires employers to “keep employee time and pay records”. Your state’s Department of Labor website determines the pay stub rules for your state.

First, you must verify if your state is opt-out or opt-in:

Opt-out States

Before a business changes the way it delivers pay stub information, it must get the employee’s consent. If the worker doesn’t consent to the change, the business must stick to the old method. Here are most of the opt-out states:

Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, Ohio, South Dakota, and Tennessee

Opt-in States:

The business must offer a paper version of the pay stub. If the employee chooses to receive pay stubs electronically, the paper version is not required. Here are most of the opt-out states:

California, Colorado, Connecticut, Iowa, Maine, Massachusetts, New Mexico, North Carolina, Texas, Vermont, and Washington.

Complex States:

Finally, these states have more complex rules than simply opt-out or opt-in. Each state’s rules are unique:

Delaware, Hawaii, Minnesota, and Oregon.

Next, determine the requirements for your specific state:

- No requirements: Some states have not created statewide rules for pay stub. As a result, employers are not required to provide a pay stub.

- Access states: These states require you to provide some form of a pay stub, either an electronic or paper version.

- Access/ print states: In these states, you can provide either an electronic or paper version. However, your employees must have a convenient way to print the pay stub, or to access it online.

If you operate in multiple states, you may have to meet several different requirements.

What Are Some Common Mistakes When Creating Pay Stubs?

Supplying incomplete or inaccurate information.

Many people make the mistake of taking pay stubs for granted. As such, a lot of them end up not putting the correct or complete information on the stub. Businesses don’t list payment dates or the pay period, or don’t include full contact details for the employer or the worker. This approach will cause trouble when computing taxes later on.

Mistake in the computations.

This is a tricky one, because there is actually quite a bit of computation that goes into making a pay stub. For example, incorrectly stating total hours worked during a pay period can result in a mistake in the year-to-date balances. Many users often put 40 hours worked on a bi-weekly pay stub while they actually meant to put down 80 hours. For this reason, it’s always better to use an automated pay stub generator. Automation reduces that likelihood that there will be a mistake in the computation.

Throwing it away.

Some people don’t pay attention to their pay stubs and throw it away without so much as a quick read through. Try to keep you pay stubs at least until the end of the tax year. These will help you verify if your employer has been making the correct payments on your behalf. Also, you may need to show your pay stubs when you apply for a loan or a try to rent a new apartment.

How Do I Create Pay Stubs Online?

Many employers are replacing payroll companies and accountant services with FormPros pay stub generator. Employees and contractors can also take advantage of this user friendly system to create pay stubs to verify employment. Formpros.com pay stub generator can instantly create your check stubs online today.

To start, you’ll need some basic contact information for both the employer and the employee. Then our intuitive form will ask you some simple questions about employee’s salary, as well as current pay date and pay period. If you have chosen our advanced template, you will be able to enter additional earned income, such as overtime, tips, holiday pay, and sick pay.

The entire process of creating a pay stub online will take you just a few minutes. Our intuitive form will even help you auto-calculate amounts that should be withheld for federal and state income taxes, FICA, Medicare, and Social Security Taxes. The form will calculate all gross, net, and year-to-date balances for the current pay period. Rest assured that your information is kept private and secure.

Why Use Form Pros Pay Stub Generator?

Our pay stub generator is a fast and easy way to create pay stubs online. The process is fully automated and user friendly. All calculations of deductions and income tax withholdings are based on current tax laws and requirements, which we keep up to date with every new tax year.

Our intuitive pay stub generator lets you instantly and efficiently create pay stub records for a fraction of the cost that you would normally pay an accountant or a payroll company.

Employee Pay Stub FAQs

-

Are pay stubs created with FormPros legal documents?

They are legal if they present accurate information and numbers from you. Please don’t use them to falsify your income as that is considered illegal.

If the details you provide are accurate, then pay stubs created using FormPros are considered legal documents and can be used as proof of income if you're an employer or authorized representative who creates pay stubs for your employees and contractors.

However, note that in order to use pay stubs as legal documents, they sometimes have to be certified or signed by the company on the pay stub.

-

Can I add custom deductions or additions, like overtime or other benefits?

Yes you have the option to add additional earnings like bonuses, overtime and tips and custom deductions like 401k and health insurance. There are no limitations to what you fill in, type a unique description, fill in the pay rate and number of hours, it’s that simple. Our generator will handle the calculations for you.

-

How and when will I receive my pay stubs?

You will instantly receive your pay stubs after you complete your payment. You will receive them in the form of a PDF that you can download, print, share and email.

-

What payment methods do you accept?

Apple Pay, Google Pay, and all major credit cards accepted. Need help? Contact us through live chat or call us at (855) 881-2648.

-

What happens if I make a mistake? Can I correct it after purchase?

You are entitled to make 1 set of edits for each pay stub you make. There is no charge for doing that. If the pay stub is more than 1 month old, you will have to create the pay stub again.

-

Is my information and data secure?

Yes, your information is 100% secure, and all data transmissions are protected by Norton SSL - Powered by DigiCert.

-

Do you offer a voided check or pay slip at the bottom of the pay stub?

Yes, you have the option to add a voided check also known as a deposit slip for an additional $1.99 per stub.

-

What format do the pay stubs come in?

The pay stubs come in PDF format, which can be viewed by any PDF viewer or web browser.

-

How can I adjust the income shown?

To calculate the income you need to enter the number of hours and pay per hour, or enter your salary if you are paid annually. Simply look for the ‘How are you paid?’ question to get started.

-

How can I adjust the YTD totals shown?

You can’t manually adjust YTD because it is automatically calculated based on the pay period you are using in your pay stub. Therefore if you are creating a pay stub for earlier in the year the YTD totals will be much lower than if you use a pay period later in the year.

-

Can I adjust the template or colors of the pay stub?

Yes we offer two main types of templates, and unlimited choices of colors. Simply look for the ‘Customize Template & Color’ link under the preview on desktop. On mobile the customization options are already open directly under the preview.

-

Can I save my employer or employee details for future use?

Not yet. This feature is coming soon.

-

How can I get help logging in or resetting my password?

To login you can simply go to Account Dashboard page, enter your email and password and click "Log in" button.

If you lost or forgotten your password, on that ‘Sign in’ page you can request a new password that you will receive in your email.

-

Do I need to print my stub on special paper?

You do not need any special paper - they can be printed on any type of paper. We suggest a plain white paper.

-

Can I generate pay stubs for multiple employees at once?

Yes, FormPros allows you to create pay stubs for multiple employees, streamlining payroll processing for small businesses and contractors.

-

Is there an option to preview the pay stub before finalizing?

Absolutely. You can preview each pay stub before completing your purchase to ensure all details are correct.

-

Do pay stubs automatically calculate taxes and withholdings?

Yes, our system includes automatic calculations for taxes and withholdings, ensuring your pay stubs are accurate and compliant.