What Information Do You Need Before Creating a Paystub?

Managing payroll takes careful planning. To ensure accuracy, you need the right information, including the data necessary to create pay stubs. A paystub information list outlines all the key details related to an employee’s pay.

Both employers and workers must understand the pay stub information on a check stub. Employers should generate accurate pay stubs that align with gross pay, tax withholdings, and other payroll amounts. Meanwhile, workers must review their paystubs to confirm they received the correct wages.

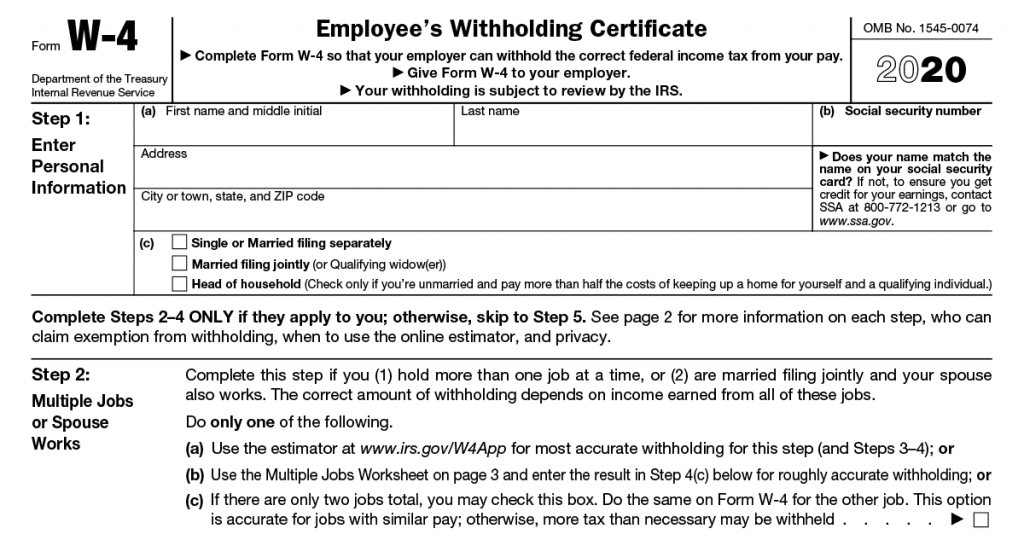

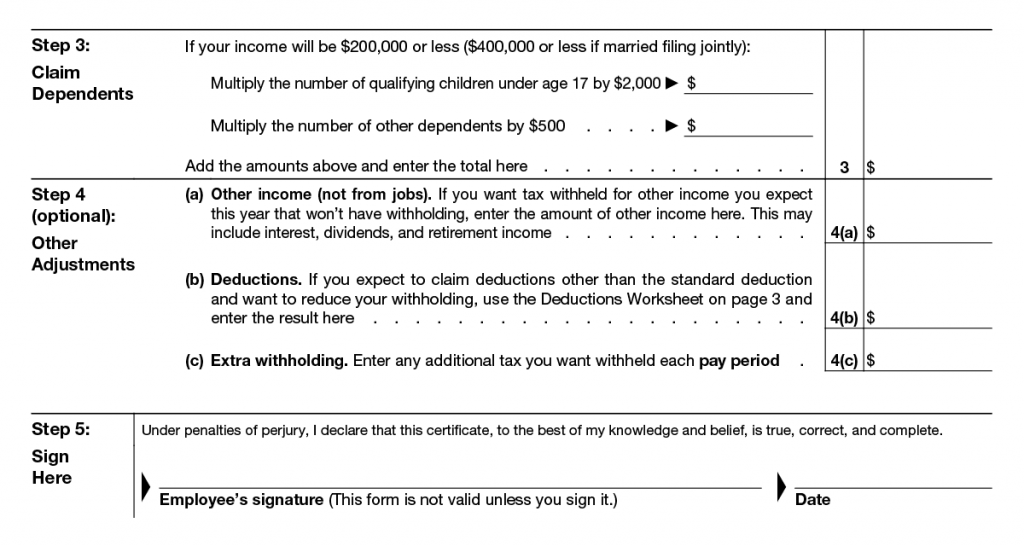

The process begins with each employee completing a Form W-4.

Working with Form W-4

Form W-4 (Employee’s Withholding Allowance Certificate) plays a crucial role in payroll processing. The federal government requires newly hired employees to complete this form, as it informs employers how much salary to withhold from each paycheck for tax purposes.

Keep these key points in mind:

- As an employer, always keep the employee’s most current W-4 form in their payroll file.

- Ensure that you enter the correct number of allowances into your payroll processing system.

- If an employee does not complete or sign the W-4 before their first payroll date, you must withhold federal income taxes as if they selected single filer status with zero allowances.

- After completion, store a signed copy of the W-4 form in your records since the IRS may request it.

Here is the W-4 form:

- Step 1: Collect the worker’s basic information (name, address, filing status).

- Step 2: Addresses employees who have multiple jobs, or who have working spouses. There are extra resources listed to calculate withholdings for these situations.

- Step 3: Compute the number of dependents.

- Step 4: Adjust your withholding amount.

- Step 5: Taxpayer signs the form.

Once you have a completed W-4, you’ll need to collect additional information for the pay stub.

Information Needed to Create a Pay Stub

Before processing payroll, ensure you gather the following details for each employee:

- Payroll cycle: The number of pay periods determines how much salary is paid on each payroll date. It also sets the start and end dates for calculating hourly wages.

- Wages: Employees may earn wages through a set salary or an hourly rate. Be sure to calculate both gross and net pay accurately.

- Tax withholdings: Federal, state, and possibly local taxes must be deducted based on the employee’s W-4 selections.

- Benefit withholdings: These deductions cover the employee’s share of insurance premiums or contributions to a retirement plan.

Since pay stub regulations differ by state, employers must verify whether they are required to provide pay stubs to workers in each state where they operate.

Employees should retain their most recent pay stubs as proof of income. Lenders often request this documentation when evaluating loan applications, and the paystub information confirms the borrower’s gross earnings.

Additionally, the pay stub information should align with each employee’s year-end W-2 form, ensuring consistency for tax filing purposes.

Specific Information on a Pay Stub

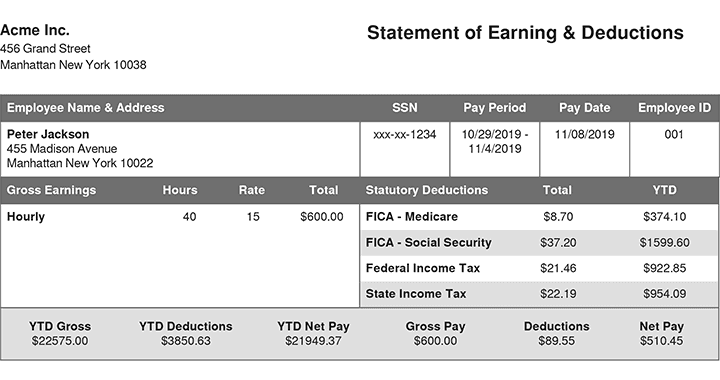

Paystub information should display the following key details:

1) Gross Wages

Gross wages represent an employee’s total earnings before any withholdings or deductions. These amounts are calculated differently based on the employee’s pay structure:

- Salaried employees: Divide the annual salary by the number of pay periods in a year.

- Hourly employees: Multiply hours worked by the hourly pay rate.

In addition to base wages, gross earnings may also include extra compensation such as sick pay, holiday pay, or bonuses.

2) Hours Worked and Pay Rate

Tracking hours worked is especially important for non-exempt (hourly) employees. Paystub information should clearly display both regular hours (up to 40 per week) and overtime hours when applicable.

Additionally, the paystub information must specify all hours worked along with the corresponding pay rate for each. Some employees, such as those covered by union contracts, may receive a predetermined overtime or double-time rate.

Even though salaried employees receive a fixed wage, their pay stubs may still list hours worked for record-keeping purposes.

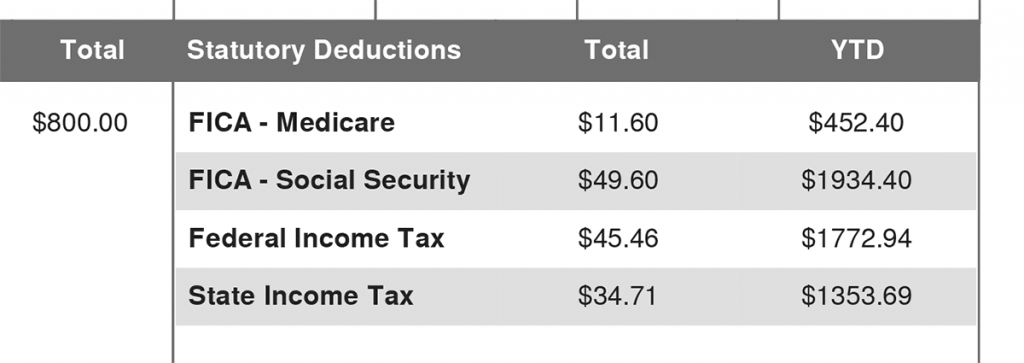

3) Tax Deductions

Employees determine their federal income tax withholdings by completing Form W-4. Additionally, each state has its own tax withholding form that may require separate documentation.

The Federal Insurance Contributions Act (FICA) tax helps fund Social Security and Medicare. In 2024, employees must contribute 6.2% of their income to Social Security, up to a wage limit of $168,600. Medicare tax applies to all wages at a rate of 1.45%, with an additional 0.9% tax for high-income earners. Combined, the total employee FICA tax rate stands at 7.65% in 2024.

Employers also contribute 7.65% toward FICA taxes, and they can deduct this cost as a business expense.

4) Benefit Deductions

Workers often pay a share of the insurance premiums for company-provided health insurance, and may contribute into retirement plan, such as a 401(k) plan. 401(k) contributions are made with pre-tax dollars, and the employer may add matching contributions.

5) Unemployment Taxes

Unemployment programs are funded by the FUTA tax (federal) and the SUTA tax (state). These amounts are paid by the employer, but also reported on the pay stub.

6) Net Pay

Net pay is the actual dollars paid to the worker, after all deductions.

*Additionally, the employee id on paystub is often listed to help verify pay records accurately. Employers must ensure that the employee id on paystub matches official HR records.*

Understanding Pay Stubs: Key Details and Why They Matter

For those unfamiliar with payroll documentation, what does a pay stub look like? A pay stub includes an employee’s wages, deductions, and net pay, structured in a clear format. Understanding what does a pay stub look like ensures accuracy when reviewing pay records.

But what important information is available on a pay stub? It includes gross pay, taxes, deductions, benefits, and net pay—all essential for financial documentation.

To ensure compliance and accurate record-keeping, employers should ask, what information is on a pay stub? A properly formatted pay stub provides a breakdown of wages, withholdings, and other payroll details. Workers should review what information is on a pay stub to ensure that their earnings and deductions are correct. For financial planning, knowing what information is on a pay stub can help track income over time.

Let FormPros Help!

Managing your finances doesn’t have to be overwhelming. Creating accurate paystubs is an essential part of maintaining organized records, staying prepared for tax season, and building financial security. With the right resources, this task can be straightforward and stress-free.

At FormPros, we simplify paystub creation with a platform that’s secure, user-friendly, and tailored to your specific needs. Beyond paystubs, we offer solutions for generating tax forms like W-2s and 1099-NECs, forming LLCs, acquiring a Registered Agent, and even creating voided checks. Whether you’re a freelancer, small business owner, or entrepreneur, we have the tools to support your success.

Don’t let paperwork slow you down. Visit FormPros today to explore how our comprehensive services can save you time, simplify your financial documentation, and empower you to focus on growing your business with confidence. Get started now and take charge of your financial management!