How to Create a Pay Stub and Calculate Wages

Creating a pay stub is an essential part of managing payroll, but the real challenge lies in knowing how to calculate wages accurately. Whether you’re an employer preparing paychecks or a contractor verifying income, understanding the math behind gross pay, deductions, and net income is critical. A pay stub is more than just a summary—it breaks down exactly how you calculate earnings and apply withholdings.

In this guide, we’ll cover the basics of what a pay stub includes, then walk through how to calculate wages step by step. We’ll show you how to calculate gross wages, identify the taxes and deductions that impact take-home pay, and use tools to automate the process accurately.

Table of Contents

Paystub Basics

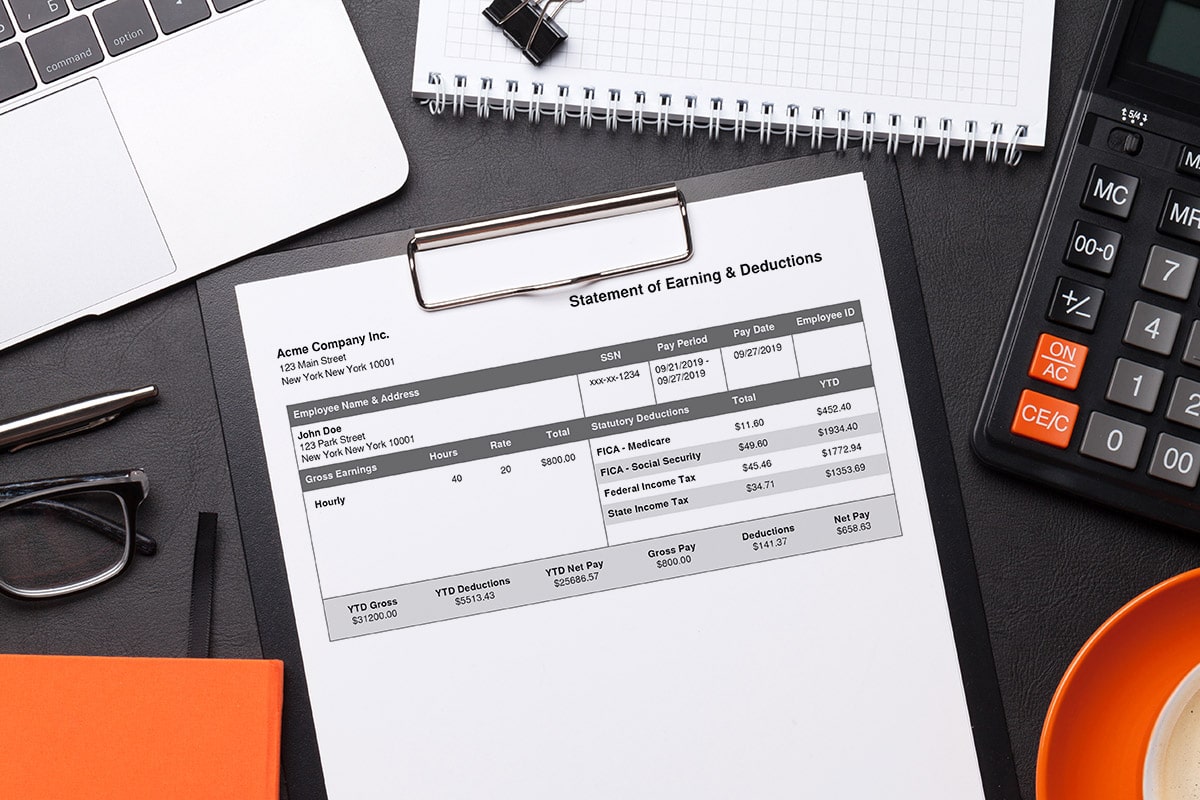

A paystub is a document that shows how an employee’s wages are calculated for a specific pay period. It typically includes key details like employee information, hours worked, gross earnings, taxes withheld, deductions, and net pay (the amount the employee actually takes home).

Paystubs can be issued digitally or in print, depending on the employer’s system. Both formats serve the same purpose—keeping a clear record of how wages are earned and adjusted.

Need a deeper breakdown? This is an in-depth explanation of everything that goes into a paystub.

How to Calculate Wages (The Core of It)

Knowing how to calculate wages accurately is the most important part of making a paystub. Let’s break down each component of the wage calculation process.

1) Gross Wages: The Starting Point

Gross wages are the total earnings before any deductions or taxes.

Hourly employees: Multiply the number of hours worked by the hourly rate.

Example: 40 hours × $20/hour = $800

Salaried employees: Divide the annual salary by the number of pay periods in a year.

Example: $52,000 ÷ 26 biweekly pay periods = $2,000

Overtime pay: Typically calculated at 1.5× the regular hourly rate for hours worked over 40 per week.

Example: 5 OT hours × ($20 × 1.5) = $150

2) Common Add-Ons to Gross Pay

Additional earnings can boost gross wages and must be included in the paystub.

- Commissions based on performance or sales.

- Bonuses for meeting goals or milestones.

- Tips, where applicable.

- Reimbursements for work-related expenses (if paid through payroll).

3) Deductions: Pre-Tax vs Post-Tax

Deductions reduce taxable income and/or net pay.

- Pre-tax deductions: Lower the taxable income before taxes are calculated. Examples include health insurance premiums, 401(k) contributions, and HSA payments.

- Post-tax deductions: Come out after taxes are applied. These might include union dues, wage garnishments, or charitable contributions.

4) Paystub Deduction Codes: Making Sense of Abbreviations

When reviewing a paystub, you may notice short codes or abbreviations next to deductions. These are deduction codes, and they serve as quick labels to identify the type of withholding applied. Understanding them helps employees (and employers) verify that the correct amounts are being withheld. Some common paystub deduction codes include:

- FED – Federal income tax

- FICA-MED – Medicare tax

- FICA-SS – Social Security tax

- 401K – Retirement contributions

- INS – Health, dental, or vision insurance premiums

- HSA/FSA – Health Savings Account or Flexible Spending Account contributions

- GARN – Court-ordered wage garnishments

5) Taxes Withheld

Employers are required to withhold several types of taxes from employee wages.

- Federal income tax: Based on the employee’s W-4 information

- FICA taxes: Social Security and Medicare

- State and local taxes: Vary depending on location

6) Net Pay: The Bottom Line

Once you subtract all deductions and taxes from gross pay, you’re left with net pay—what the employee actually takes home.

Formula:

Gross Pay – Deductions – Taxes = Net Pay

Example Wage Calculations

Let’s bring it all together with two examples—one for an hourly employee and one for a salaried employee. These will show how gross pay, deductions, and taxes all lead to the final net pay.

– Example 1: Hourly Employee –

- Name: Alex

- Hourly rate: $18

- Hours worked: 42

- Overtime: 2 hours × ($18 × 1.5) = $54

- Gross pay: (40 × $18) + $54 = $774

Deductions and Taxes

- Pre-tax health insurance: $50

- Federal income tax: $70

- Social Security & Medicare (FICA): $59.23

- State tax: $25

Net pay calculation:

$774 – $50 – $70 – $59.23 – $25 = $569.77

– Example 2: Salaried Employee –

- Name: Taylor

- Annual salary: $60,000

- Pay schedule: Biweekly (26 pay periods)

- Gross pay: $60,000 ÷ 26 = $2,307.69

Deductions and Taxes

- 401(k) contribution (pre-tax): $150

- Federal income tax: $230

- FICA: $176.54

- State tax: $90

Net pay calculation:

$2,307.69 – $150 – $230 – $176.54 – $90 = $1,661.15

Take Charge of the Process

While it’s important to understand how to manually calculate wages, most businesses and freelancers use digital tools like FormPros to streamline the process. The FormPros paystub generator takes care of the heavy lifting—automatically calculating gross pay, deductions, and taxes while formatting everything professionally for your records.

Still, accuracy is key. Even when using a tool, make sure to double-check:

- That hours worked, pay rates, and pay periods are correct

- Employee or contractor details are accurate

- Deductions and tax settings reflect your current local and federal requirements

Using a tool like FormPros doesn’t replace due diligence—it enhances it, helping you save time while keeping your payroll accurate and compliant.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

FAQs

-

What’s the difference between a paystub and a paycheck?

A paycheck represents the actual payment an employee receives—either as a physical check or through direct deposit. A pay stub, on the other hand, shows how the employer calculated that payment, including wages, deductions, and taxes. The stub explains the “why” behind the paycheck amount.

-

How long should employers keep paystub records?

Employers should keep paystub records for at least three years, though some states or industries may require a longer period. Detailed records support audits, resolve disputes, and ensure compliance with labor laws. Many employers use digital storage, as long as they keep records accessible and secure.

-

Do freelancers or 1099 workers get paystubs?

Typically, clients don’t issue paystubs to freelancers, but freelancers can create their own to track income. Tools like FormPros let 1099 workers generate paystubs for proof of income, loan applications, or recordkeeping—even without formal documentation from an employer.

-

Can paystubs be used to prove employment?

Yes, pay stubs can help verify employment, especially when they include the employer’s name, the employee’s name, pay period, and earnings. However, for official purposes, employers may also need to provide an employment verification letter alongside the pay stubs.

-

What happens if a mistake is found on a pay stub?

If you spot an error on a paystub—like a miscalculated deduction or incorrect hours—report it immediately to payroll or HR. Employers typically must correct the issue promptly and may provide an amended paystub or back pay when necessary.