What is the official name of Form 1099-MISC and what is its purpose?

The official name of Form 1099-MISC is “Miscellaneous Information.” Its purpose is to report payments made in the context of business to non-employees or unincorporated businesses. This includes payments such as rents, services, prizes and awards, other income, medical and health care payments, crop insurance proceeds, cash payments for aquatic life, and payments to attorneys. The form ensures accurate tax reporting and compliance. It also promotes transparency in income declaration by recipients who are not employees of the payer. Many businesses choose to use a 1099 generator to streamline this process and ensure accuracy.

Why is Form 1099-MISC important?

Form 1099-MISC is crucial because it allows businesses to report payments made to non-employees, such as independent contractors. It also covers other payments not included in traditional payroll taxes. This form helps ensure the IRS can track and tax income that might otherwise go unreported. Many companies opt to create a 1099 to avoid compliance issues and maintain proper financial records. By detailing non-payroll payments, it helps both the payer and recipient maintain accurate tax records and comply with federal tax obligations.

Who is required to submit a Form 1099-MISC?

Businesses must submit Form 1099-MISC for payments of at least $600 made during the course of trade or business. This applies to individuals, contractors, and unincorporated entities who are not employees.

Qualifying payments include services, rent, prizes and awards, other income, medical and health care payments, crop insurance proceeds, certain fish purchases, and payments to attorneys. Many companies use a 1099 generator to simplify this process and ensure all necessary forms are filed correctly.

What are the specific steps to obtain and correctly complete Form 1099-MISC?

Obtaining and completing Form 1099-MISC involves several steps. First, you can download the form from the IRS website or order an official paper copy if filing by mail. Alternatively, businesses can create 1099 online using trusted tax software. This reduces manual errors and ensures compliance with IRS requirements.

For the main part of the form, fill in the boxes corresponding to the type of payment made. Each box represents a different type of income. For example, enter the amount paid to a contractor in Box 7 for nonemployee compensation if it is at least $600. Other boxes cover rents, royalties, medical and health care payments, and other income types.

Many small businesses and freelancers prefer to create 1099 online free when possible. They use digital tools like FormPros to simplify filing without additional expenses.

When and how often do you need to file Form 1099-MISC, and are there any associated deadlines?

Form 1099-MISC must be filed annually. The issuer is required to send out the form to each recipient by January 31st following the tax year in which the payments were made. Subsequently, it should be filed with the IRS by the end of February of that same year. If you opt to file electronically, the deadline is extended to March 31st. Many businesses choose to use a 1099 creator to meet these deadlines efficiently.

Are there any consequences for late submission of Form 1099-MISC?

Yes, there are consequences for the late submission of Form 1099-MISC. The IRS may impose penalties for failing to file on time, which vary depending on how late the form is submitted. The penalty increases the longer the delay, starting from $50 per form if the delay is up to 30 days and reaching as high as $290 per form for submissions after August 1st or not submitted at all. If you’re unsure how to make a 1099, it’s best to use an online filing system to ensure accuracy and avoid penalties.

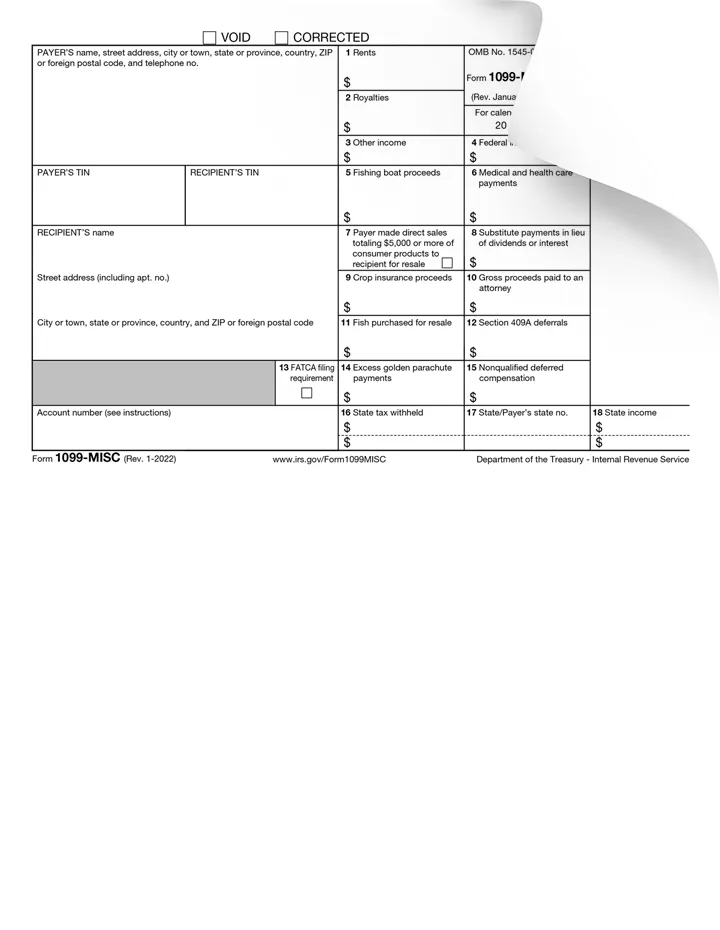

Can you list the key components or sections that Form 1099-MISC comprises?

Form 1099-MISC comprises several key components including:

Payer’s information: This section includes details such as the payer’s name, street address, city, state, zip code, and telephone number.

Recipient’s information: Similar to the payer’s information, this part requires the recipient’s name, address, and taxpayer identification number (TIN), which can be a Social Security Number (SSN), Employer Identification Number (EIN), or Individual Taxpayer Identification Number (ITIN).

Account number: Optional section used if the payer has multiple accounts for a recipient to differentiate the statements.

Various income boxes: These boxes are used to report different types of payments such as:

- Rents

- Royalties

- Other income

- Medical and health care payments

- Nonemployee compensation

- Fish purchased for resale

- Crop insurance proceeds

- Payments to an attorney

- Section 409A deferrals and Section 409A income

- State tax withheld information: Includes state tax withheld, payer’s state number, and state income.

Each box on the form is designated for reporting specific types of payments, and the payer fills out the box or boxes that correspond to the nature of the payment made to the recipient. The form also includes sections for reporting any federal and state tax withheld.

What documents should I have on hand to help me complete these sections accurately?

To accurately complete Form 1099-MISC, you should have records of all payments made that fall under the categories reported on the form. Specifically, ensure you have access to your accounting records, invoices, and contracts that detail payments made to non-employee service providers, rent payments, prizes and awards, and other payments that meet or exceed the $600 threshold.

Additionally, healthcare payments should be documented with invoices from providers, and records pertaining to fish purchased from those in the business of fishing are also necessary. Maintaining detailed financial ledgers and bank statements can further support the accuracy of your entries. Having these documents will help verify each transaction and ensure all required payments are reported correctly.

A case study showcasing the importance of Form 1099-MISC.

Imagine a small freelance graphic design business, “Creative Visions,” which regularly engages multiple freelance artists, a local printing company, and a legal advisor to manage contracts. Throughout the year, “Creative Visions” pays each freelance artist $1,000 for their services, $700 to the printing company for brochures, and $2,000 to the legal advisor. In absence of a tracking and reporting mechanism like Form 1099-MISC, it would be challenging for both “Creative Visions” and its contractors to manage, report, and verify their income accurately to the IRS.

By issuing Form 1099-MISC to each contractor, “Creative Visions” not only adheres to IRS mandates but also ensures that all parties report their income correctly. This accurate reporting helps avoid penalties and ensures proper taxation. When the freelance artists receive their Form 1099-MISC, it motivates them to accurately declare their income in their tax returns, leading to rightful tax contributions based on legitimate earnings. Moreover, the precise reporting aids “Creative Visions” in tracking its expenses professionally, which is beneficial during the company’s financial audit.

Overall, the use of Form 1099-MISC underlines the commitment to transparency in business operations, fostering trust among contractors and aiding in seamless compliance with tax laws. Without the form, there might be risks of under-reporting of income, resultant penalties from the IRS, and a possible breakdown of business credibility.

How do I file Form 1099-MISC?

To file Form 1099-MISC, you must first ensure you have the correct form for the relevant tax year. You can order these forms from the IRS or obtain them from an authorized IRS distribution center or office supply store. It’s important to note that the forms must be filled out on the scannable originals due to the specific red ink used. Alternatively, many businesses prefer to create 1099 electronically to eliminate the hassle of handling physical forms.

For the IRS, you must submit Copy A of each 1099-MISC form you’ve completed. The deadline for filing with the IRS is typically February 28th if filing by paper, or March 31st if filing electronically. If you are filing 250 or more forms, you are required to file electronically.

To file electronically, you must use the IRS Filing Information Returns Electronically (FIRE) system. Before you can use the FIRE system, you need to create an account and obtain a Transmitter Control Code (TCC). Ensuring you have compatible software that can produce a file in the format acceptable to the IRS will make it easier to create a 1099 online efficiently.

Are there any specific regulations or compliance requirements associated with Form 1099-MISC?

Form 1099-MISC is governed by specific IRS regulations that mandate the issuance of this form for various types of payments totaling $600 or more to a single recipient within a tax year. These payments pertain to services performed by non-employees, rents, prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, and attorney payments. The form must be provided to the recipient by January 31st following the tax year in which the payments were made, and filed with the IRS by the end of February.

If filing electronically, the deadline extends to March 31st. Non-compliance with these regulations, including failure to issue a 1099-MISC where required, or incorrect or late filings, can result in penalties from the IRS.

Additionally, businesses must ensure they also meet any applicable state requirements for issuing 1099 forms, which can vary.

What resources are available for assistance in completing and submitting Form 1099-MISC (e.g., professional advice, official instructions)?

Several resources are available to assist in the completion and submission of Form 1099-MISC. The IRS provides official instructions, which are comprehensive and can be found on their website. These instructions outline the various requirements, such as how to fill out and file the form correctly. In addition to the IRS resources, many software companies offer tax preparation software that supports the creation and electronic filing of Form 1099-MISC. This software often simplifies the process by automating many tasks and ensuring compliance with tax regulations.

For those seeking personalized guidance, consulting with a professional accountant or tax advisor is recommended. These professionals can provide tailored advice based on individual or specific business circumstances, which is particularly useful for complex situations. Their expertise can help avoid common mistakes and potentially reduce the risk of penalties associated with incorrect filings. Furthermore, tax preparation services, often available from financial institutions or dedicated tax preparation firms, offer another layer of assistance, including options for direct consultation and electronic filing.

What are some common errors to avoid when completing and submitting Form 1099-MISC?

When completing and submitting Form 1099-MISC, it’s important to avoid common errors to ensure accurate reporting and compliance with IRS requirements. Here are some common errors to avoid:

1. Incorrect Taxpayer Identification Numbers (TINs):

- Ensure that the TINs for both the payer (the entity issuing the form) and the recipient (the individual or business receiving the payments) are accurate. Incorrect TINs can lead to reporting issues and potential penalties.

2. Inaccurate or Incomplete Recipient Information:

- Verify that all recipient information, including names and addresses, is accurate and complete. Incomplete or incorrect information can cause processing delays and errors in reporting.

3. Misreporting Nonemployee Compensation (Box 1):

- Accurately report the total amount of nonemployee compensation paid to the recipient during the year. Misreporting this amount can lead to incorrect tax calculations for the recipient.

4. Incorrect Reporting of Rents (Box 1):

- Ensure that rental payments are correctly reported. Misclassifying other types of payments as rents can lead to discrepancies and potential audits.

5. Misreporting Royalties (Box 2):

- Accurately report the total amount of royalties paid. Misreporting this amount can affect the recipient’s tax calculations and lead to discrepancies.

6. Incorrect Federal Income Tax Withheld (Box 4):

- Ensure that any federal income tax withheld from the payments is accurately reported. Incorrect reporting can lead to discrepancies on the recipient’s tax return.

7. Failing to Report Other Income (Box 3):

- Accurately report other income that does not fit into the specific categories of rents, royalties, or nonemployee compensation. Misreporting can lead to incorrect tax filings.

8. Misreporting Medical and Health Care Payments (Box 6):

- Ensure that payments made to medical and health care providers are correctly reported. Misclassifying these payments can cause discrepancies.

9. Failing to Report Fishing Boat Proceeds (Box 5):

- Report any fishing boat proceeds accurately. Omitting these payments can lead to underreporting of income.

10. Misreporting Section 409A Income (Box 15b):

- Accurately report any deferrals included under Section 409A that were includible in income. Misreporting can affect the recipient’s tax liability.

11. Failing to File Timely:

- Submit Form 1099-MISC to the IRS and provide copies to recipients by the required deadlines. Late filings can result in penalties and interest charges.

12. Not Filing Electronically When Required:

- If you are required to file 250 or more Forms 1099-MISC, you must file electronically. Failing to do so can result in penalties.

13. Incorrect Filing of Corrections:

- If a correction is needed, ensure that you file the corrected Form 1099-MISC properly. Follow the IRS guidelines for submitting corrected forms to avoid confusion and potential penalties.

14. Failing to Provide Copies to Recipients:

- Ensure that recipients receive their copies of Form 1099-MISC by the required deadline. Failing to provide these copies can result in penalties and may cause recipients to underreport their income.

15. Ignoring IRS Updates and Changes:

- Stay informed about any changes or updates to IRS forms and reporting requirements. Ignoring these updates can lead to outdated or incorrect filings.

16. Poor Recordkeeping:

- Maintain accurate and detailed records of the payments reported on Form 1099-MISC. Inadequate recordkeeping can complicate filing and hinder the ability to provide accurate information.

17. Misreporting State Information:

- Ensure that state income, state tax withheld, and payer’s state number are correctly reported. Misreporting state information can lead to discrepancies in state tax filings.

By avoiding these common errors, issuers can ensure accurate and timely filing of Form 1099-MISC, minimizing the risk of penalties and ensuring compliance with IRS regulations.

How should you retain records or copies of the submitted Form 1099-MISC and associated documents?

It is important to retain a copy of Form 1099-MISC along with any related documents for at least three years after the due date of the return or the date it was filed, whichever is later. This retention period ensures compliance with IRS guidelines and supports possible audits or inquiries. Maintaining organized records can be done electronically or in paper form. Ensure that electronic records are backed up and stored securely. Proper documentation might include accounting ledgers, contracts, invoices, or payment records that corroborate the information on the filed forms. Keep these documents in a secure location where they are protected from damage or unauthorized access.

How do you stay informed about changes in regulations or requirements related to Form 1099-MISC?

Staying informed about changes in regulations or requirements related to Form 1099-MISC involves several proactive strategies. Regularly checking the Internal Revenue Service (IRS) website, particularly the page dedicated to Form 1099-MISC, is one of the most direct ways to keep up-to-date since the IRS posts updates and guidance there. Subscribing to IRS newsletters, such as the “IRS Guidewire” or “IRS Newswire,” which provide official updates and news releases on tax regulations, can be extremely helpful.

Attending webinars and seminars hosted by tax professionals or industry associations can also provide insights and detailed explanations of any new changes to Form 1099-MISC. Additionally, consulting with a tax professional or accountant who stays abreast of tax laws and can provide personalized advice based on your business’s specific needs is advisable. They can also assist in implementing the changes in reporting practices required by the updated regulations. Lastly, reading publications and articles from trusted financial and tax advisory sources can further ensure that you are well-informed about the current requirements and any forthcoming adjustments to the use of Form 1099-MISC.

Are there any exemptions or exceptions to the requirement of filing Form 1099-MISC?

Yes, there are certain exemptions to the requirement of filing Form 1099-MISC. Payments made to corporations, including S corporations, are generally exempt from reporting on Form 1099-MISC, except in cases of payments to attorneys or payments for medical and health care services. Additionally, payments for merchandise, telegrams, telephone, freight, storage, and similar items do not require reporting on Form 1099-MISC.

Moreover, payments made via credit card or payment card and certain third-party network transactions are not reported on Form 1099-MISC but are reported on Form 1099-K by the payment settlement entity. Lastly, the IRS provides exceptions for specific types of payments detailed in its guidelines, so it’s recommended to check IRS rules or consult with a tax professional for specific transactions.

Are there any penalties for inaccuracies or omissions on Form 1099-MISC?

Yes, there are penalties for inaccuracies or omissions on Form 1099-MISC. These penalties can vary depending on the nature and severity of the error, such as failing to file the form on time, failing to include all required information, or for intentionally disregarding the requirement to report correctly. The penalties can range from monetary fines starting at $50 per form if the delay in filing is corrected within 30 days, up to $280 per form if the problem is not corrected by August 1st.

Penalties can increase significantly, up to $570 per form or more, for intentional disregard of the filing requirements. Additionally, these penalties are applied for each instance of non-compliance, which means they can accumulate quickly if multiple forms are involved.

How does Form 1099-MISC impact an individual or entity’s tax obligations?

Form 1099-MISC impacts an individual or entity’s tax obligations by ensuring the accurate reporting of non-employee compensation and other miscellaneous income. When a business or individual receives this form, it indicates that the income they earned from specific services, such as freelance or contract work, as well as rents, prizes, and other specified payments, has been reported to the IRS. The recipient must then include this income on their tax return. The inclusion of 1099-MISC income affects the overall taxable income for the year, potentially altering the amount of tax owed or the size of a refund.

Moreover, by providing an official record of payments, Form 1099-MISC helps both payers and payees comply with federal tax laws and assist in the accurate calculation of self-employment taxes when applicable. Hence, this form plays a crucial role in defining the tax responsibilities and obligations of the payee, ensuring that both federal and state income taxes are paid correctly and on time.

Is there a threshold for income or transactions that triggers the need to file Form 1099-MISC?

Yes, the requirement to file Form 1099-MISC is triggered when payments of at least $600 are made during the year in the course of a business to a non-employee or an unincorporated business for services rendered, rents, prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, and certain other transactions.

Are there any circumstances where Form 1099-MISC may need to be amended after filing?

Yes, Form 1099-MISC may need to be amended after filing if there are errors in the information previously reported. Examples of situations that might necessitate an amendment include:

- Incorrect payment amounts

- Misreported taxpayer identification numbers

- Incorrect recipient names

To amend a Form 1099-MISC, the payer must complete a new form, marking the “Corrected” box at the top to indicate that it is an amendment to previously filed information. The corrected form must then be sent to both the IRS and the recipient.

How does Form 1099-MISC affect financial reporting for businesses, organizations, or individuals?

Form 1099-MISC plays a critical role in the financial reporting for businesses, organizations, and individuals by providing a structured way to report specific types of payments that are not covered under traditional employment terms. This form ensures these entities accurately document payments such as rents, services exceeding $600, and other specified categories of payments to non-employees or unincorporated businesses. Recording these payments helps in maintaining clear and compliant financial records and aids in the preparation of income statements and the balancing of books. For the recipients of these funds, the form is essential as it details their income from various sources, which must be reported on their tax returns.

By aiding in the tracking and reporting of these payments, Form 1099-MISC ensures that all parties involved meet their federal tax obligations and accurately report their income, ultimately impacting their tax liabilities and financial statements. This process helps in preventing tax evasion and ensures reliable financial audit trails for both payers and recipients. Furthermore, adhering to the IRS’s deadlines for issuing and filing the form prevents penalties and facilitates timely financial reporting.

Can Form 1099-MISC be filed on behalf of someone else, such as a tax preparer or accountant?

Yes, Form 1099-MISC can be filed on behalf of someone else by a tax preparer or accountant, provided they have the necessary authorization to act on behalf of the payer. This is commonly done when the payer outsources their tax reporting obligations to professionals who handle their accounting and tax filings. This allows for more efficient and accurate compliance with tax regulations.

Are there any fees associated with filing Form 1099-MISC?

There are no direct IRS fees associated with filing Form 1099-MISC. However, businesses may incur costs related to preparing and sending the forms, such as expenses for software, form acquisition, and delivery. These costs vary depending on whether the filing is done on paper or electronically and on the tools or services used to prepare and file the forms.

Additionally, if a business chooses to use a tax professional or a filing service to manage and submit their 1099 forms, they will incur fees based on the service provider’s rates.

How long does it typically take to process Form 1099-MISC once it’s been submitted?

The IRS does not specify an exact processing time for Form 1099-MISC once it’s been submitted. However, it generally takes a few weeks for the IRS to process these forms after they are filed. If the form is filed electronically, the process may be faster compared to paper filing. It is essential for filers to allow sufficient time for processing to ensure that any related tax obligations or corrections can be addressed well before the tax return due dates.

Can Form 1099-MISC be filed retroactively for past transactions or events?

Yes, Form 1099-MISC can be filed retroactively for past transactions or events if it was not filed when originally required. It’s important to correct this as soon as possible to avoid penalties from the IRS for late filing. When filing retroactively, you should use the form for the specific tax year during which the transactions occurred and follow the IRS guidelines for late filing, including possibly providing an explanation for the delay.

Are there any specific instructions or guidelines for completing Form 1099-MISC for international transactions or entities?

Form 1099-MISC should be issued for payments made to non-U.S. residents only if the services are performed in the U.S. Payers must generally withhold 30% from the payment for tax purposes, unless a treaty provision reduces or exempts the non-resident from U.S. taxation, and they must file Form 1042-S, “Foreign Person’s U.S. Source Income Subject to Withholding.” The international entity or individual might also need to provide a Form W-8BEN or W-8BEN-E to certify their foreign status and claim any applicable treaty benefits. Ensure you review the current IRS guidelines on international payments and tax withholding as these requirements can be subject to changes.

What digital tools or software are recommended for generating and managing Form 1099-MISC?

FormPros could be a suitable tool for generating and managing Form 1099-MISC, as we offer customizable templates and features designed to streamline the process. Additionally, popular accounting software such as QuickBooks or Xero often include features for generating and managing tax forms like the 1099-MISC. These tools can automate much of the process and help ensure compliance with tax regulations. However, it’s essential to review the specific features and capabilities of each tool to determine which best suits your needs.

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even voided checks, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Form 1099-MISC FAQs

-

What should I do if I receive a Form 1099-MISC with incorrect information?

If you receive a Form 1099-MISC with incorrect information, contact the payer (the entity that issued the form) immediately to request a corrected form. Retain documentation of your request and any responses. Use the corrected form to accurately report the information on your tax return.

-

How does a payment recipient correct information on a Form 1099-MISC?

As a payment recipient, you cannot directly correct a Form 1099-MISC. Instead, you must contact the payer who issued the form and request that they file a corrected Form 1099-MISC with the IRS. The corrected form will have the "Corrected" checkbox marked and should be used for your tax reporting.

-

When is Form 1099-MISC not required despite payments being made?

Form 1099-MISC is not required in the following situations:

- Payments to corporations, except for payments for medical and health care services, attorneys, and certain other exceptions.

- Payments for merchandise, telegrams, telephone, freight, storage, and similar items.

- Payments of rent to real estate agents.

- Payments made through third-party payment networks (these are reported on Form 1099-K if thresholds are met).

-

Is electronic filing of Form 1099-MISC accepted, and if so, how does it work?

Yes, electronic filing of Form 1099-MISC is accepted and encouraged. Payers can file electronically using the IRS FIRE (Filing Information Returns Electronically) system. If you are required to file 250 or more forms, you must file electronically. The process involves creating an account on the FIRE system, submitting the forms in the required electronic format, and ensuring compliance with IRS guidelines.

-

What are the specific identification requirements for the payer and payee on Form 1099-MISC?

The specific identification requirements include:

- Payer’s Information: The payer's name, address, and taxpayer identification number (TIN).

- Payee’s Information: The payee's name, address, and TIN (such as a Social Security Number or Employer Identification Number). Ensure that this information matches the payee’s records to avoid discrepancies.

-

How can a recipient verify the authenticity of Form 1099-MISC received?

To verify the authenticity of Form 1099-MISC, recipients should:

- Confirm that the payer's name and contact information are accurate.

- Check that the payment amounts match their records.

- Contact the payer directly to confirm the issuance of the form if there are any doubts.

- Verify the TIN and other identifying information.

-

What are the consequences for not reporting payments using Form 1099-MISC?

Failing to report payments using Form 1099-MISC can result in penalties for the payer, including:

- Penalties for failure to file correct information returns.

- Penalties for failure to furnish correct payee statements.

- Increased scrutiny from the IRS and potential audits.

- For the payee, unreported income can lead to underpayment of taxes, penalties, interest, and possible audits.

-

How do changes in business structure affect reporting obligations under Form 1099-MISC?

Changes in business structure, such as transitioning from a sole proprietorship to a corporation, can affect reporting obligations. For example:

- Payments to corporations are generally exempt from Form 1099-MISC reporting, except for certain types of payments like medical and health care payments and legal services.

- Ensure that the business's TIN and classification are updated with the IRS and communicated to payers to reflect the new structure.

-

Can Form 1099-MISC be corrected after it has been filed, and what is the process?

Yes, Form 1099-MISC can be corrected after it has been filed. The process involves:

- Filing a new Form 1099-MISC with the correct information.

- Checking the "Corrected" box on the top of the form.

- Submitting the corrected form to both the IRS and the recipient.

- Including the original, incorrect form’s information as required to indicate that it is a correction.