What is a Voided Check?

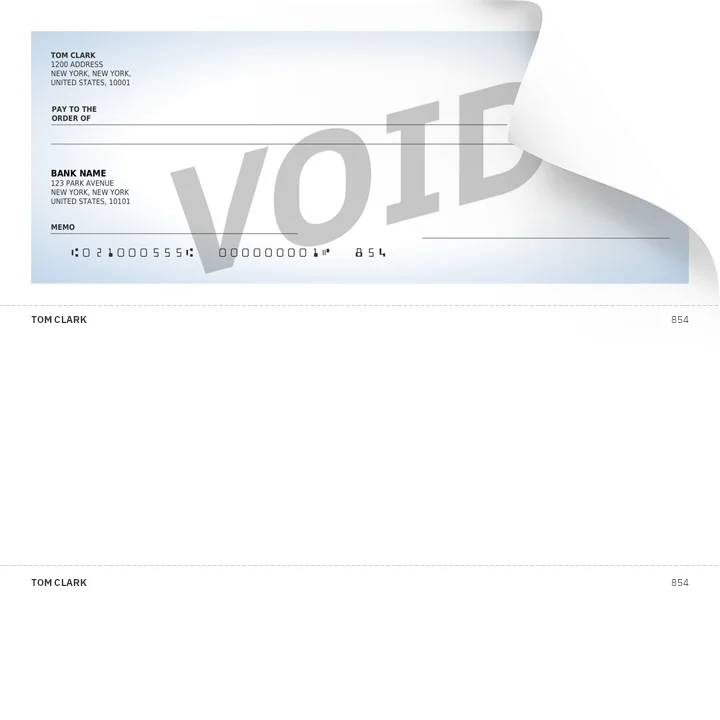

A voided check (also known as a nullified payment slip or invalid bank draft) refers to a check that has the word “void” written across the front of it. This ensures that no one can use the check for unauthorized payments. If you’re unsure how to write a voided check, the process is simple—just make sure the word “VOID” is clearly visible and doesn’t obscure your banking details.

People typically write ‘void’ on the blank check using permanent blue or black ink to prevent easy erasure.

Why Do You Need to Use Voided Checks?

Although electronic banking has become increasingly popular, people still void a check to submit their banking details for direct deposits and automatic bill payments.

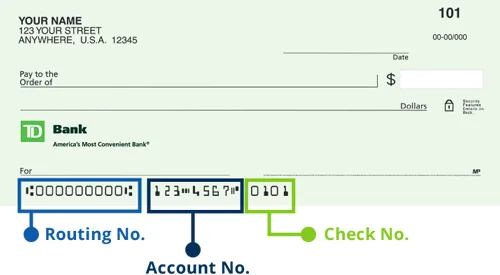

This is because checks contain the following important information:

- The name of your bank or credit union union.

- Your bank account number.

- A routing number, which identifies the bank you use.

This information gives employers, contractors and financial institutions everything they need to set up an electronic link to an account for deposits or withdrawals.

When Do You Need a Nullified Payment Slip?

Now that you better understand voided checks, let’s explore when to use them.

To Schedule Direct Deposits — Some employers and payroll departments still use a nullified payment slip form to set up direct deposits for their employees’ paychecks. The information provided on invalid bank drafts also allows the employer to ensure that their employees’ bank account details are accurate before they make any payments.

To Set Up Automatic Payments — Many people use nullified payment slips to schedule automatic electronic payments for their own personal use or if they run a business. For example, if your business pays contractors electronically, you may need to submit a voided check to authorize automatic payments into their bank accounts.

*Similarly, if you want to set up automatic mortgage, rent, or car loan payments, a invalid bank draft may be necessary. If you need a voided check example, many banks provide sample voided checks or digital versions you can use for reference.*

What Is the Difference Between a Voided and Canceled Check?

The key difference between a voided check and a canceled check lies in their purpose and usage:

Voided Check:

- A check that has “VOID” written across it, making it unusable for payment.

- Used to provide banking details for setting up direct deposits, automatic payments, or electronic transfers.

- The bank never processes it for payment, but it serves as a reference for account information.

Canceled Check:

- A check that the bank has processed and paid, meaning it has already transferred the funds.

- It cannot be used again since the bank has cleared it.

- Often used as proof of payment for transactions.

In short, an invalid bank draft becomes deliberately unusable before processing, while the bank has already processed and cleared a canceled check.

Are There Any Alternatives to a Voided Check?

Some people no longer have access to a check register, while others hesitate to sacrifice a check by voiding it.

In these cases, there are a few alternatives to voiding a check:

- A direct deposit authorization form: These are documents that allow third parties to send money directly into an individual’s bank account.

- A voided counter check: This is a blank check that people receive when they first open a bank account. People often use these while the bank prints personalized checks.

- A photocopy of a check or deposit slip that contains your bank and deposit account details.

*If you’re wondering how to get a invalid bank draft, these alternatives can help when you don’t have access to a physical checkbook.*

Where Do You Get Voided Checks?

There are several ways to obtain a voided check, depending on your preference and urgency.

1 – One option is to request a invalid bank draft directly from your bank. Some banks have specific procedures in place to issue voided checks, helping to minimize errors or fraud. However, this process can take time since the bank may need to order and print the check for you.

2 – Alternatively, you can void a check yourself by writing “VOID” in large, clear letters across the front. Be sure to cover most of the check without obscuring your banking details at the bottom. Some people choose to write “VOID” in multiple sections, such as the date, payee, amount, and signature lines, as an added precaution.

While manually voiding a check is simple, it carries some risks. If you don’t properly void the check and it falls into the wrong hands, someone could alter or misuse it.

3 – Use an Online Voided Check Generator – If you need to know how to get a voided check online, services like FormPros allow you to generate a voided check instantly. This method eliminates waiting times, reduces the risk of human error, and formats your check correctly.

For those searching for a voided check example, these digital solutions can provide a clear template that meets financial institutions’ requirements.

Why Use Our Voided Check Generator?

At FormPros, we have developed an efficient and convenient solution to creating voided checks online. Our software helps you create voided checks in a matter of minutes. We also offer a subscription plan so that you can create unlimited voided checks at a lower cost.

The best part? FormPros does not require the installation of additional software, which will save you even more time and money. If you’re still wondering what does a voided check look like, our tool can provide a perfectly formatted void check example in seconds.

Final Thoughts

If you’re still unsure how to make a voided check, the process is straightforward, whether you do it manually or use a digital service. Whether you need a voided check example for setting up direct deposits, automatic payments, or other financial needs, making sure your check is properly voided is essential.

Still asking yourself what does a voided check look like? Try FormPros today and generate a professional, error-free nullified payment slip instantly!

FormPros Has You Covered

Simplify your paperwork with FormPros! From creating paystubs, W-2s, and 1099-NEC forms to generating LLC Operating Agreements and even employment verification letters, our easy-to-use platform has you covered. Save time, reduce errors, and handle your business documents with confidence. Start now and see how FormPros makes professional form generation fast, affordable, and hassle-free!

Voided Check FAQs

-

Where can I find my bank routing number and account number?

The routing number, a nine-digit sequence, can be found in the lower-left corner of your check. The account number is the set of numbers, located just to the right of the routing number. The shorter set of numbers on the far right side represents your check number. If you don't have access to a physical check, you should be able to retrieve this information by logging in to your bank's website and selecting your account.

-

What are the risks of nullified payment slips?

The main risk involves the exposure of your banking details. Always ensure you are giving the voided check to a reputable and trustworthy entity. Avoid sharing it publicly or online.

-

Can I reuse a voided check for multiple setups?

Yes, the same voided check can be used to set up multiple direct deposits or automatic payments, as the account and routing numbers don't change.

-

What should I do with a voided check?

Keep a record of it in your check register and store the voided check securely until you've confirmed that the direct deposit or automatic payment setup is successful. Then, it can be shredded.

-

Can I void a check after sending It?

Once a check is sent, you cannot void it. If you need to stop a check you've already sent, you will have to contact your bank to issue a stop payment order, which may come with a fee.

-

Is it safe to give a nullified payment slip?

Yes, it is generally safe as it can't be used to withdraw money. However, it does contain sensitive information, so ensure you're providing it to a trusted party.

-

What if I don't have checks?

If you don't have checks, you can ask your bank for a "pre-printed" invalid bank draft, a letter with your account information, or use an alternative method like a bank deposit slip with the account information handwritten on it. As a great alternative you can utilize the formpros.com voided check generator which allows you to easily create a invalid bank draft online.

-

How do I void a check?

Write "VOID" in large letters across the front of the check. Ensure it's readable but doesn't cover the account and routing numbers. It's also a good practice to record the voided check in your check register.

-

Can I provide a digital copy of a voided check?

It depends on the company's policy. Some may accept a digital copy, while others might require a physical check. It's best to ask the specific company for their requirements.

-

Is it safe to email a nullified payment slip?

While emailing a invalid bank draft is common, it's important to ensure the email is sent securely due to the sensitive information on the check. Use encrypted email if possible.

-

What should I avoid when voiding a check?

Answer: Avoid obscuring the account and routing numbers. Also, don't use a check that has any other writing or signatures on it, other than the word "VOID".

-

What to do if a nullified payment slip is misused?

If you suspect misuse of a nullified payment slip, contact your bank immediately to take appropriate action, which might include monitoring your account for fraudulent activity or closing the account.

-

Can I use a voided check for proof of bank account ownership?

Yes, a invalid bank draft is often used as proof of account ownership since it displays your name, account number, and bank routing number.

-

What alternatives can I use if I can't provide a invalid bank draft?

Alternatives include a bank deposit slip with your account information, a bank statement, or a direct deposit authorization form provided by your bank.